The Random Walk indicator is used to determine if an issue is trending or in a random trading range. It attempts to do this by first determining an issue's trading range. The next step is to calculate a series of RWI indexes for the maximum look-back period. The largest index move in relation to a random walk is used as today's index. An issue is trending higher if the RWI of highs is greater than 1, while a downtrend is indicated if the RWI of lows is greater than 1.

Presentation

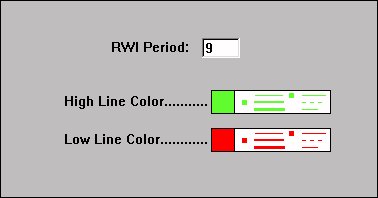

Above is a 5 Minute Bar Chart of an S&P 500 Future Contract (SP`M). The bold green line in the lower pane represents the High Line of the Random Walk, while the red line represents the Low Line.