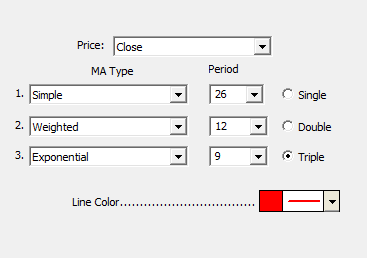

The triple smoothing indicator can be used to compute and graph either a double or triple smoothing of the price data for an instrument. Each smoothing moving average has its own period and type specification. The first moving average is applied to the raw price data of the instrument. The second moving average is then applied to the first result. If triple is selected, the third moving average is then applied to the second result. Double or triple smoothed moving averages can be used instead of single moving average lines to look for trading signals as two moving average lines cross. The extra smoothing generally results in fewer false signals.

Presentation

Above is a 5 Minute Candlestick Chart of an Real Networks (RNWK). The bold white line represents a triple smoothing of the closing price of each bar.