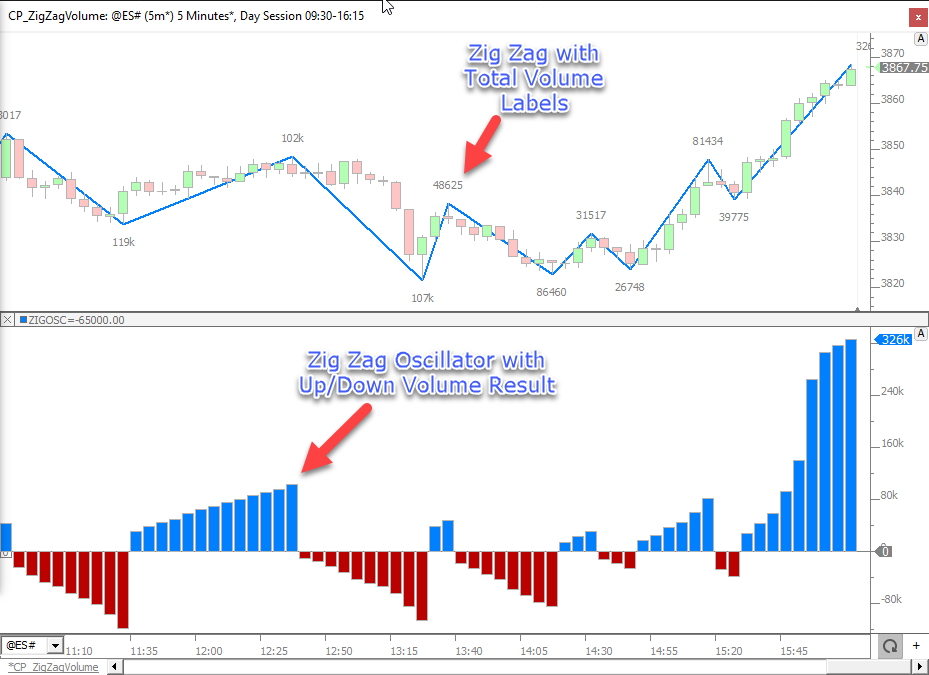

The Zig Zag Oscillator indicator provides a way of viewing the Zig Zag Indicator information in a different form, oscillating about 0. The indicator represents the percent change at each bar of the current price from the base price of the current Zig Zag leg. When the Zig Zag is currently in an uptrend state, the Zig Zag Oscillator will be above 0. Similarly, when the Zig Zag is in a downtrend state, the oscillator will be below 0. Optionally, reference lines may be drawn at any percent change level. If a reference line value of 10% is specified, reference lines will be drawn at both 10% and -10%. It is common to draw the reference lines at the same level as the minimum percent change level, in order to clearly see when prices have reached the minimum required level.

A "Results" option has been added to the Zig Zag Oscillator indicator. This option will default to "Zig Zag Percent Change" which is the result that Zig Zag Oscillator has given in prior releases of Investor/RT. Four new choices provide access to a variety of data elements regarding the Zig Zag Oscillator. Each result option is discussed below: Zig Zag Percent Change This result represents the percent change of the current price (close) from the previous pivot price. Retracement Level This result represents the retracement level of current price in respect to the last leg of the Zig Zag. Pivot Price This result represents the price of the last Zig Zag pivot point. Previous Pivot Price This result represents the price of the next to last Zig Zag pivot point. Direction This result represents the direction of the current Zig Zag leg. A value of 1 represents the current leg is upward trending, while a value of 0 represents that the current leg is downward trending.

Zig Zag Line Price The Zig Zag oscillator indicator has a new result option titled "Zig Zag Line Price", that may be useful in RTL formulas For any bar you can now easily compare the current price to the value of the current Zig Zag leg at that bar. Keyboard Adjustment NA

Presentation

Above is a Daily Bar Chart of Real Networks (RNWK). The Zig Zag indicator overlays the bars, drawn as successive black trend lines using the preferences below.