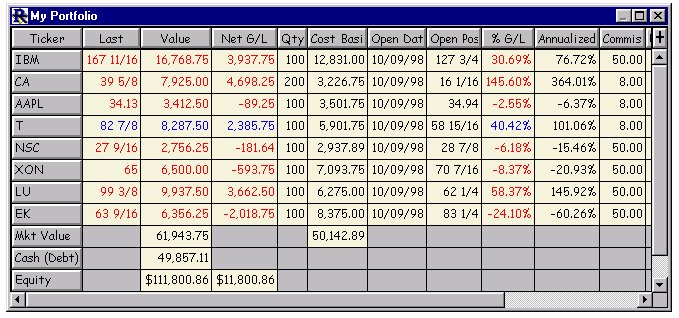

The portfolio object is a spreadsheet with many characteristics in common with the quote page object. The key difference is that the portfolio contains only instruments in which the user has an open position. Each row of the portfolio spreadsheet represents an open position in a particular instrument. A position may be long or short, cash or on margin. The portfolio object performs a variety of accounting functions to show the gain or loss in each position and the total gain/loss of the portfolio as price updates are received. The gain/loss calculations are automated for most security types including futures contracts, stocks, mutual funds, bonds, and equity and index options.

Investor/RT Portfolios value all open positions with every tick. Choose from 50 data columns to set up portfolios that instantaneously calculate net gain/loss, % gain/loss, annualized % gain/loss, etc. It even maintains a seperate credit and debit balance to handle short sale accounting. Here are some additional features offered by Investor/RT Portfolios:

Investor/RT Portfolios value all open positions with every tick. Choose from 50 data columns to set up portfolios that instantaneously calculate net gain/loss, % gain/loss, annualized % gain/loss, etc. It even maintains a seperate credit and debit balance to handle short sale accounting. Here are some additional features offered by Investor/RT Portfolios:

- password protection for opening portfolio

- sort ascending/descending for any data column

- asset allocation calculation

- portfolio value graphing

Investor/RT provides facilities for entering positions into a portfolio or for entering trading orders. Trading orders, when later confirmed by the user, cause a new position to be added to the portfolio. Investor/RT is designed to support electronic order entry. At present no order execution is available.

The portfolio object enables the user to track dividends and interest earned and interest and commission expenses associated with each position in order to calculate annualized rate of return on each open position.

Each portfolio may be assigned a privacy password to protect the confidentiality of the portfolios. When a password is assigned to a portfolio, the password must be entered when the portfolio is opened for viewing. Portfolio passwords may be changed at any time or eliminated if desired.

The portfolio object in Investor/RT is a spreadsheet object much like the quote page. The key difference is that the portfolio tracks positions. Each row in a portfolio represents a position. The columns in the portfolio represent the data items for each position. These include the name and ticker of the instrument, the number of shares or contracts, the type of position--long or short, cash or margin, the entry date. Some data columns are calculated each time an updated quote or trade price arrives for an instrument which has a position in the portfolio. These include the current value of the position, the gain/loss, and an annual rate of return on the position. You may define as many distinct portfolios as you wish. Each portfolio has a cash balance, called the credit balance, that tracks the cash on hand in the account. The credit balance is adjusted when you open or close positions in the portfolio. Each portfolio also has a debit balance, used to keep track of margin liabilities when you purchase a security on margin. When you close a margin position, the proceeds are used first to clear the margin liability from the debit balance. Any excess proceeds (the profit) is then added to the credit balance. When a loss is incurred when closing out a margin position, cash to taken from the credit balance as needed to eliminate the margin liability.

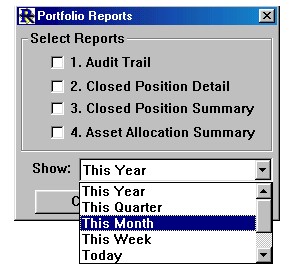

With a portfolio window open, click the "Portfolio Reports" button on the portfolio toolbar. The Portfolio Reports window will appear.

Select one or more reports and click the "Report" button to view the report(s). At present, there are four reports available:

- Audit Trail

- Closed Position Detail

- Closed Position Summary

- Asset Allocation Report

The number keys 1 through 4 are shortcuts for selecting or deselecting the associated report. These are the same reports that have been available for some time in Investor/RT. The Close Position Detail report has been improved to show the entry and exit price per share for each closed position. Further, reports 1-3 can now be viewed for a variety of times spans. This limits the reports to all activity that has occurred within the current year, the current quarter, the current month, week, or day. Selections are also available for "Last Year" and "All Years". In future releases we will be adding additional report types for selection from this window.