Beta measures the volatility of a security relative to something else, usually a benchmark index like S&P. To calculate beta, you scatter plot the bar to bar changes of the symbol (stock or fund) along with the bar to bar changes of an index on an XY graph (with the index going on the X axis) for a user-specified period. A best fit (regression) line is then drawn through these points. The slope of that line is beta, while the Y intercept is alpha. A beta that is greater than one means that the fund or stock is more volatile than the benchmark index over the given period, while a beta of less than one means that the security is less volatile than the index. A beta of 0.9 should be interpreted as follows: the stock/fund would return only 9% while the market/index went up 10%, however, it would it would lose only 9% while the market/index dropped 10%. Similarly, a beta of 1.5 would be interpreted as follows: the stock/fund would return 15% while the market/index went up only 10%, however, it would it lose 15% while the market/index dropped only 10%. Alpha is a measure of residual risk of an investment relative to some market index. Alpha is the Y intercept of the best fit line mentioned above. Alpha is expected to be equal to risk-free rate times (1 - beta). The following equations explains the relationship between alpha, beta, and the Stock and Index returns.

StockReturn = Alpha + Beta * IndexReturn

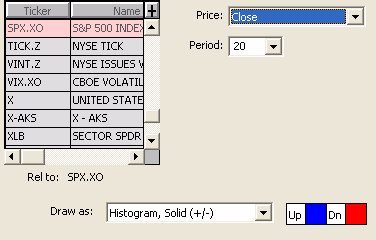

The preference windows for both Alpha and Beta are essentially identical. Both ask the user to specify the underlying symbol (generally an index like S&P), a price, a period, and drawing style. Again, the underlying symbol should generally be an index such as S&P, and that symbol should have data for the same period that is being studied. The price should generally be "close", but the user may choose to use something like that High/Low average. Commonly, beta and alpha are calculated over 3 or 5 year periods of monthly data. This would require a period of 36 or 60, and a periodicity of monthly. RTL Token . . . ALPHA / BETA ( more )

Presentation

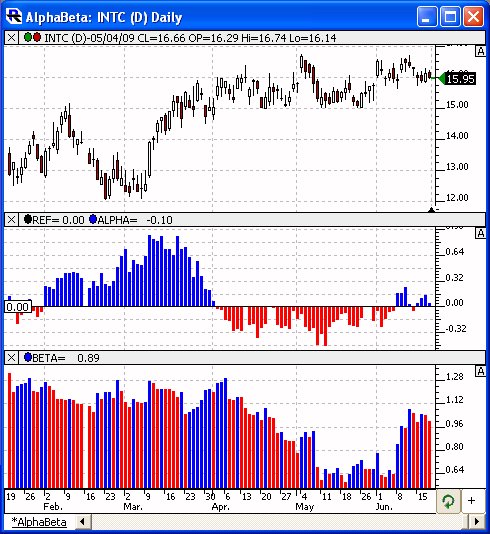

The chart above is a Daily chart of INTC. The middle pane shows the 20-Period Alpha of INTC relative to SPX (see prefs below). The lower pane shows the 20-period Beta of INTC relative to SPX.