The Modified Moving Average is an algebraic technique that makes averages more responsive to price movements. The average includes a sloping factor to help it catch up with the rising or falling value of the security.

Presentation

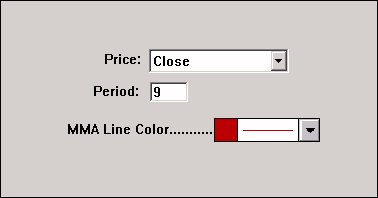

Above is a One Minute Bar Chart of Real Networks(RNWK). The Modified Moving Average is seen as a red line in the chart. This moving average uses the preferences seen below.