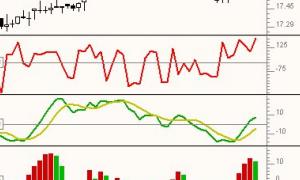

Indicator Adjusted Average (IIA)

Indicator Adjusted Average computes a Moving Average whose period varies within a specified range and is determined based on the value of another indicator within that indicators range. The indicator used to control the variance of the moving average period can be any of the 80+ predefined indicators or even a custom indicator created using the Investor/RT RTL language.