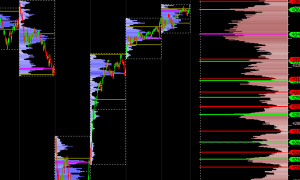

Volume Breakdown (VB)

The Volume Breakdown is a powerful and flexible indicator used to gauge buying and selling pressure. It looks inside each bar, breaking down and classifying each tick and then accumulating the results (accumulation is optional), and further giving the user a variety of statistical measures (including all built-in technical indicators) to apply the these results. The most common use of the VB indicator is to calculate the delta (difference between the buy (ask-traded) and sell (bid-traded) volume) of each bar. Positive deltas signify more buying pressure, while negative deltas signify more selling pressure. The magnitude of the delta determines the strength of that pressure. Expect to see positive deltas during uptrends and negative deltas during downtrends, but look for delta turning negative at highs, or turning positive at lows...a sign of possible market turns and good entry/exit points.