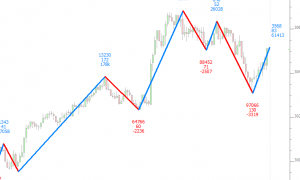

Analysis Of A Move

This video demonstrates how to analyze moves by accumulating statistical data from each price move and labeling the end points of those moves with the data values. This analysis is available to both the Zig Zag indicator for automatic identification of moves as well as the Trendline indicator for manual identification of moves.