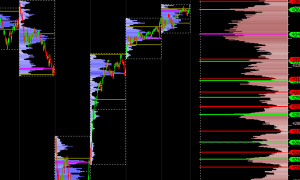

Spirals (Logarithmic Spirals)

The Spiral indicator (also know as the "Logarithmic Spiral") provides a link between price and time analysis, and can help in forecasting both price and time. Similar to indicators such as Fibonacci Retracements, Fibonacci Arcs, and Gann Angles, the Spirals indicators is based off a trendline which connects a significant high with a significant low. The spiral can be drawn in a clockwise and/or counter-clockwise direction originating from the endpoint of the trendline.