How would I add a chart button that toggles (adds/removes) a technical indicator with specific preferences?

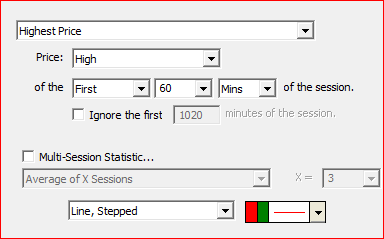

Here is an example: assume we want to create a button that will toggle Pivot Point indicator lines on and off. First, add the Pivot Point indicator to your chart with the preferred settings. To create a toggle button for any indicator in your chart, right-click on the indicator and choose "Add Button" from the ensuing pop-up menu. The button will then appear in the chart. To test it, click the button and watch the indicator in question disappear and then return as you click.