Tutorial - Scans - Miscellaneous

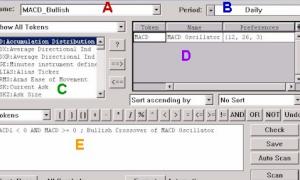

Now let's look at some other useful scan operators and commands...

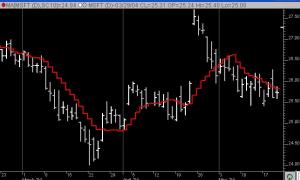

The command ROU(expression, n) takes the expression and rounds it based on the number n. For instance, if you supply an n of 0.01, it will round the value (HI + LO) / 2 to the nearest 100th. Similarly, if you specified a value for n of 1, it would have rounded the result to the nearest whole number, and assigned it to V#1.