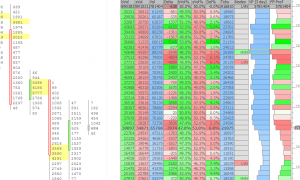

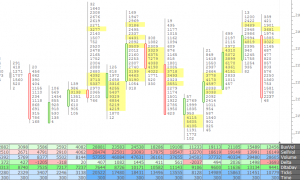

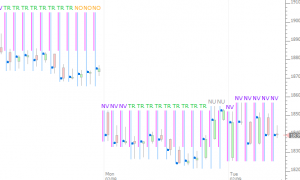

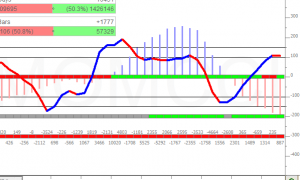

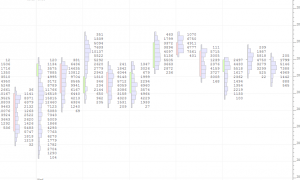

VolumeScope® (RTX)

VolumeScope is the best in class footprint charting available, allowing the user to view per bar market order flow under a microscope, closely inspecting the volume at price data with great flexibility. The VolumeScope indicator has three primary components: Background, Text, and Candle. Each is optional and each has a variety of data and presention settings. Volume is broken down into Ask-Traded Volume (Buying) and Bid-Traded Volume (Selling) at each price. VolumeScope builds upon this information with profiling, coloring, and scaling options based upon relative volume, delta, imbalance, and much more.