Vervoort Oscillator (RTX)

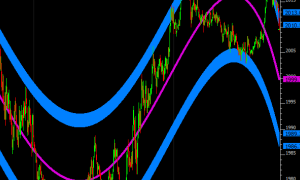

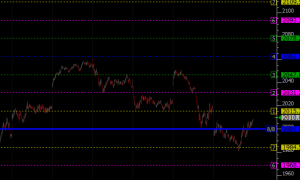

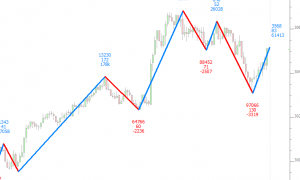

In his article "The Quest For Reliable Crossovers" (Stocks and Commodities Magazine, May 2008) author Sylvain Vervoort explains a trading method using the crosses of two moving averages: a zero-lag triple exponential moving average of the typical price HLC/3 and the Heiken-Ashi Close. The Vervoort Oscillator plots the difference between these averages. Vervoort recommended a 55 period average (1 period look back) on daily charts.