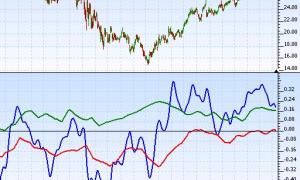

Fractals - Swing Highs, Swing Lows

The Investor/RT Fractal indicator is based upon the "Bill Williams Fractal" in the book "Trading Chaos" by Bill Williams, PhD. A fractal is an entry technique that is traditionally defined as "a bar that has two preceding and two following bars with lower highs (or lower lows, on a down move)". Several different varieties of up and down bar 5-bar fractal formations can be seen below.