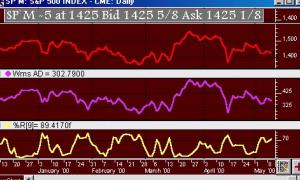

Chart Buttons

Chart Buttons enable you to add push buttons or menu buttons to any chart window to perform a variety of actions as shown in the image below. Buttons can be added to any pane of any chart just as you would add any indicator. If you have a series of button indicators that you wish to appear in every chart, set the scope of the button to "All Charts, Any Instrument" at the bottom of the Button Preferences window. From that point forward, any chart you open or create in the future will have the these ticker and periodicity buttons.