Stock Split Finder

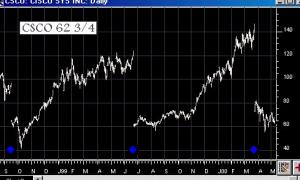

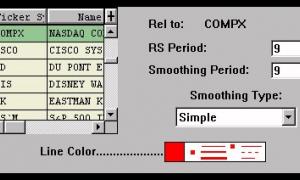

The Split Finder may be added to a chart window or used in a scan to locate stocks with abrupt price changes indicative of stock splits. You may specify a percentage price change from one day to the next that the Split Finder will use to locate possible splits. The default is 10% When the Split Finder is added to a chart window, the title bar of the chart pane indicates if a split has been detected. When the mouse points to the effective date of the split the title bar will indicate the date and the split ratio found.