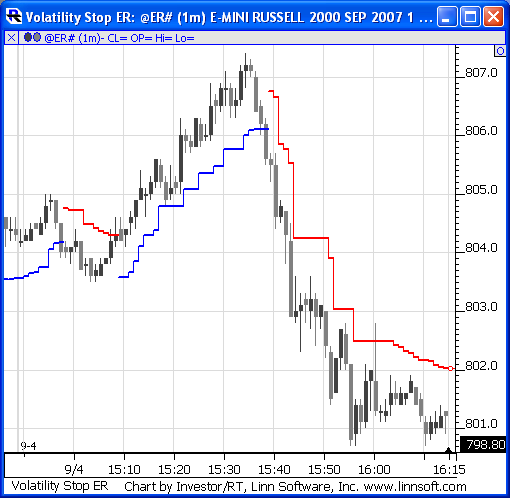

The Volatility Stop Indicator helps define the current trend. The indicator plots a red line above the prices bars when a downward trend is detected, and a blue line below the bars when an upward trend is detected. These lines are commonly used as trailing stops. This indicator is commonly used as a exit tool rather than an entry technique. When price crosses the VSTOP value, the trend reverses and VSTOP moves to the other side of price. The VSTOP calculation method can be found above.

Long... CL > VSTOP AND CL.1 <= VSTOP

Short... CL < VSTOP AND CL.1 >= VSTOP Keyboard Adjustment NA

The Formula

When Up Trend Detected.... VSTOP = CL - MULT * TR

As Up Trend Continues.... VSTOP = MAX(VSTOP.1, MaxCL - MULT * TR)

When Down Trend Detected.... VSTOP = CL + MULT * TR

As Down Trend Continues.... VSTOP = MIN(VSTOP.1, MinCL + MULT * TR)

Where... CL = Closing Price MULT = True Range Multiplier TR = True Range VSTOP.1 = Volatility Stop Value on Previous Bar MaxCL = Maximum Closing Price since Up Trend Began MinCL = Minimum Closing Price since Down Trend Began

Trend reverses between up and down when Closing Price crosses VSTOP.

Presentation

Above is a 1-minute of the Russell Mini Contract (@ER#, DTN IQFeed). The Volatility Stop Indicator is plotted overlaying the candlesticks. The blue line represents areas where an upward trend is detected. Red line represents areas where a downward trend is detected. The preferences seen below were used in this instance.