The Signal Statistics indicator (SSTAT) allows for statistical calculations on signals, including summation, consecutive signals, frequency, bars since last signal, change since last signal, and more. SSTAT allows the user to select any existing scan or signal, and any custom statistical result to calculate on that scan/signal. Currently, the available statistical results are:

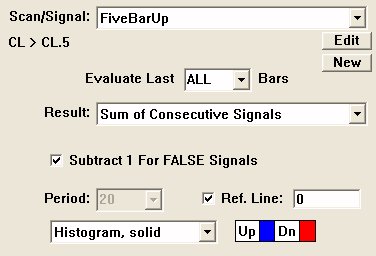

- Sum of Consecutive Signals - This result will give the number of consecutive signals that have occurred, whether TRUE of FALSE signals. For instance, a value of +7 represents 7 consecutive TRUE signals. If the underlying scan is CL > CL.1, then this value of +7 represents 7 consecutive increasing closes. Conversely, using the same example scan, a value of -5 would represent 7 consecutive bars where the CL was less than or equal to the previous CL. There is also an option for "Subtract 1 For FALSE Signals". If this option is not checked, the result will always be positive, and will just be reset to 0 when a FALSE signal occurs. If this option is checked, each consecutive FALSE signal will subtract 1 from the result. When the signal first changes from FALSE to TRUE, the result is always 1, and will then build with each consecutive TRUE signal. When the signal changes from TRUE to FALSE, the value will be -1 if "subtract" is checked, or 0 if "subtract" is unchecked. If "subtract" is checked, each consecutive FALSE signal will continue to build in the negative direction. If "subtract" is unchecked, each FALSE signal will keep the result at 0 until a TRUE signal gets things going back into the positive direction.

- Sum of All Signals - This result works exactly as the "Summation of Consecutive Signals" option discussed above, except that the result does not reset when the signal reverses. In other words, if the result is currently +7, and a FALSE signal occurs, then the result becomes either +6 or +7 depending on whether the "subtract" option is checked, whereas the result would have become either -1 or 0 with the "Consecutive" option.

- Bars Since Last Signal - This result option gives the number of bars since the scan/signal last hit TRUE. This result is always positive or 0. A value of 0 means the the scan hit on the current bar (or that a TRUE signal hasn't occurred yet). A value of 12 means that the signal last hit TRUE 12 bars back, followed by 11 bars of FALSE signals.

- Running Total - This options keeps a running total of both the TRUE and FALSE signals. If a TRUE signal occurs, the result will be a positive number representing the total number of TRUE signals that have occurred as of that bar, including that bar. If a FALSE signal occurs, the result will be a negative number representing the total number of FALSE signals that have occurred as of that bar, including that bar.

- Frequency Over Recent Period - When this result option is selected, a "period" preference is presented. The result is number of times the signal hit TRUE over the period specified. For instance, if the period was 20, and the result was 5, this would indicate that the signal was TRUE 5 of the previous 20 bars, and FALSE on the other 15.

- Percent Of Recent Period - This option is similar to the "Frequency Over Recent Period" option, except it returns a percentage of bars for which the signal hit TRUE. For instance, if the period was 40, and the result was 20%, this would indicate that 20% of the 40 bars (or 8 bars) were TRUE, while 80%, or 32, were FALSE.

- Percent Of All Bars - This option is gives a result that represents the percentage of all previous bars, including current bar, for which the scan/signal was TRUE. When viewing this indicator in a chart, each bar, moving right, will be considering one additional bar than the bar to it's left. And the rightmost (current) bar in the chart will be considering all bars. Each bar is considering itself and all bars to it's left. The number of bars in the chart is dictated by the "Viewing Period" setting in the Chart Preferences.

- Price At Last Signal - This result gives the closing price of the bar on which the scan/signal last was TRUE. This result only changes when a TRUE signal occurs, and will then remain constant across FALSE signals. This option could be useful in scans or trading signals in combination with the "Bars Since Last Signal" option.

- Change Since Last Signal - This result gives the change in price since the last TRUE signal occurred. This value will become 0 when a TRUE signal occurs, and then will build in either direction on FALSE signals as the price changes since the last TRUE signal.

- Sum Of Session Signals (Intraday) - This result only applies to intraday charts/data. The result on each bar is the sum of all TRUE signals that have occurred as of that bar (including that bar) during the current session. The result will reset to 0 at the beginning of each session and will build by increments of 1 each time a new signal occurs.

- Profit/Loss - Look Ahead - This result uses the specified period to calculate a look ahead profit/loss value for each TRUE signal. For instance, if the period was 20, then each time a TRUE signal occurred, then the result would be the price 20 bars ahead, minus the price of the current bar. This option allows you to peek into the future with historical data to see how your signals would perform given a specific period of time. If there are insufficient bars ahead of the signaled bar, then the profit/loss will be computed based on the last bar (price of last bar minus price of signaled bar).

- Highest High Since Signal - This result gives the highest high (price) that has been realized since the last TRUE signal. This result can only increase between signals. On the signaled bar, the result will be the close of that bar. If the high of the following bar is higher than that close, then the result will increase to this new high. This will continue until the next signal hits, at which point the result will be reset to the close of the newly signaled bar.

- Lowest Low Since Signal - This result gives the lowest low (price) that has been realized since the last TRUE signal. This result can only decreased between signals. On the signaled bar, the result will be the close of that bar. If the low of the following bar is lower than that close, then the result will decrease to this new low. This will continue until the next signal hits, at which point the result will be reset to the close of the newly signaled bar.

- Price Before/After Last Signal - This result works identically to "Price At Last Signal" except a period is provided to allow access to the price of bars before or after the signaled bar. A period of 0 will cause this result to be identical to "Price At Last Bar". A period of 10, for instance, will cause the result to be the price of the 10th bar preceding the signaled bar. A negative value may be specified to access bars following the signaled bar. For instance, a period of 5 with a price of "High" would result in the high of the 5th bar following the signaled. The result will only change bars that signal TRUE, and then hold that value until the next signal.

- Short Profit/Loss - Look Ahead - This result works the same as the "Profit/Loss - Look Ahead" option, except the profit is based on a short trade. In other words, a decreasing price change results in a profit, while an increasing price change results in a loss.

- Maximum Profit Since Signal - The maximum potential gain based on the highest high achieved since the signal occurred relative to the entry price on the signaled bar. This result provides a value on each bar following the signal, and resets at each signal.

- Maximum Loss Since Signal - The maximum potential loss based on the lowest low achieved since the signal occurred relative to the entry price on the signaled bar. This result provides a value on each bar following the signal, and resets at each signal.

- Max Favorable Excursion - Look Ahead - This result looks ahead from the signaled based on the period specified, and finds the maximum potential gain achieved over that period, based on the highest high reached during the period. This result appears only on the signaled bars, showing a value of 0 on all other bars.

- Max Adverse Excursion - Look Ahead - This result looks ahead from the signaled based on the period specified, and finds the maximum potential loss achieved over that period, based on the lowest low reached during the period. This result appears only on the signaled bars, showing a value of 0 on all other bars.

- MFE Period (Bars to MFE) - Bars to MFE This result shows how many bars forward from the signal at which the MFE (Maximum Favorable Excursion) price was reached. In other words, it represents how many bars from the signaled bar that the highest high occurred over the period specified.

- MAE Period (Bars to MAE) - Bars to MAE This result shows how many bars forward from the signal at which the MAE (Maximum Adverse Excursion) price was reached. In other words, it represents how many bars from the signaled bar that the lowest low occurred over the period specified.

- Bars From Signal To Highest Price - This result gives the number of bars from the signal to the highest price since the signal. This may be useful in identifying divergence.

- Bars From Signal To Lowest Price - This result gives the number of bars from the signal to the lowest price since the signal. This may be useful in identifying divergence.

- Bars Since N Signals Ago - This result gives the number of bars between the current bar and the bar at which N signals ago occurred. For example, if a value of N=3 was specified, then a resulting indicator value of 20 would mean that the third signal back occurred 20 bars ago.

- Price At N Signals Ago - This result gives the price of the bar at which N signals ago occurred. For example, if a value of N=2 was specified, then a resulting indicator value of 54.5 would mean that the price was $54.5 on the bar where the second signal back occurred.

- Highest Price Since N Signals Ago - This result gives the highest price since N signals ago occurred. For example, if a value of N=4 was specified, then a resulting indicator value of 63.5 would mean that the highest price that was reached since the bar at which the 4th signals back occurred was $63.5.

- Lowest Price Since N Signals Ago - This result gives the lowest price since N signals ago occurred. For example, if a value of N=4 was specified, then a resulting indicator value of 43.5 would mean that the lowest price that was reached since the bar at which the 4th signals back occurred was $43.5.

SSTAT can be drawn as either a histogram (hollow or solid) or a line (connected or continuous). An optional reference line can be drawn in the chart. A reference line at 0 is appropriate for most result options. The selected scan/signal can be edited by simply clicking a button directly in the SSTAT preferences. When the underlying scan/signal is modified and saved, the results will be seen immediately in the corresponding SSTAT. RTL Token . . . SSTAT ( more )

Presentation

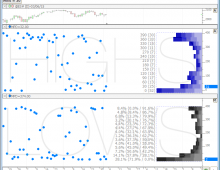

Above is a Daily Candlestick Chart of an Microsoft Corporation (MSFT). The Signal Statistics indicator is drawn as a blue and red solid histogram in the lower window pane, using the preferences seen below.

Keyboard Adjustment

The period involved in the SSTAT indicator can be adjusted directly from they keyboard without opening the preferences window. First, select the indicator, then use the up and down arrow keys to adjust the period up or down by 1. The period is only relevant to certain results (Frequency Over Recent Period, Percent Of Recent Period, and Profit/Loss - Look Ahead).