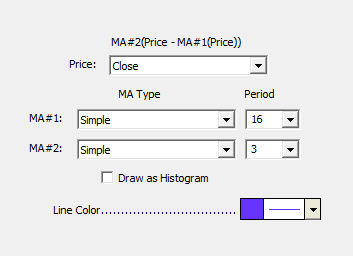

The Detrended Oscillator is calculated by first calculating the difference between "price" and a user specified moving average of "price" for the instrument. The price used may, of course, be the high, low, close, open, average of high and low, or average of high, low, and close. The resulting array of differences is then smoothed according to another user specified moving average. The resulting indicator oscillates around zero. This indicator makes it easy to spot situations when an instrument is trading at historical extremes relative to its average price. The Detrended Oscillator can be used in scans, trading signals, and custom indicators.

Presentation

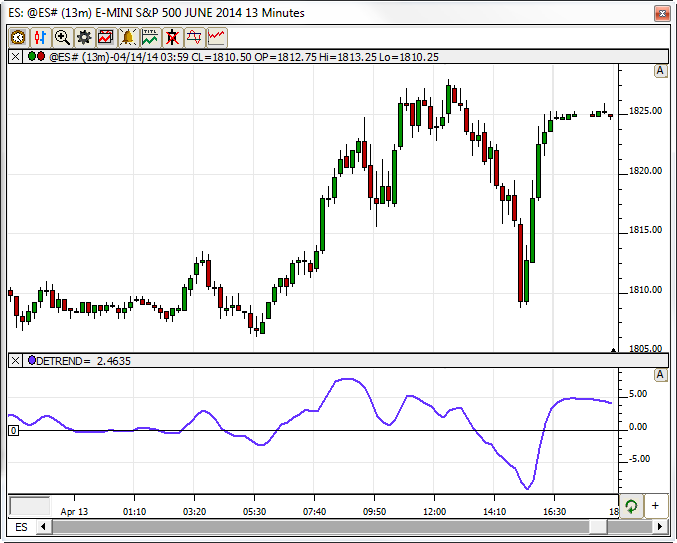

Above is a 13 Minute Line Chart for the S&P 500 Emini contract (ES June 2014). In the lower pane, the Detrended Oscillator is drawn in a blue color below. The oscillator oscillates around a reference line of zero.