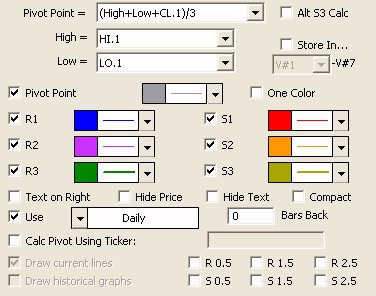

The Pivot Point study is one which works best in markets with a wide daily trading range (high volatility). The study uses the previous day high, low, close, and open price to generate a pivot, two support levels, and two resistance levels. Because it is generated from daily data it is recommended that you check the "Use Daily" checkbox when adding this study to an intraday chart. Otherwise, the pivot point lines will be calculated using bars of whatever periodicity the chart is in.

Price crossing the pivot on an up move is a bullish event; a cross below the pivot on a down move is a bearish event. Once a bullish indication has registered the study offers two resistance levels for the price to test. If the first resistance is penetrated price can be expected to test the second resistance. The same idea holds true for the support levels on a downward cross of the pivot point.

Choosing a Pivot Point

The user now has a great deal of flexibility available in selecting what data will be used in calculating the pivot point and the support and resistance levels. Some of the pivot point options include:

- (High + Low)/2

- (High + Low + CL.1)/3

- (High + Low + CL.1 + OP.1)/4

- (High + Low + CL.1 + OP)/4

- (High + Low + CL + OP)/4

- (High + Low + CL)/3

- (High + Low + OP)/3

- (High + Low + 2*OP)/4

The expression CL.1 represents the closing price of the previous day, while the expression OP represents the opening price of the current day or session. Notice that each expression has two common components, High and Low. The values used for the High and Low will in turn be based upon what is selected from the list box in the preferences. Some choices available for High include:

- HI.1

- HI

- MAX(HI, HI.1)

- MAX(HI, HI.1, HI.1)

- V#1

- V#2

- V#3

- . . .

Whatever expression is selected here will be substituted for "High" in the equation for Pivot Point, as well as the equations for support and resistance levels Similar, whatever expression is chosen in the "Low" listbox will be substituted for "Low" in all equations.

As an example, assume the user chose the following options:

Pivot Point: (High + Low + CL.1) / 3 High: HI.1 Low: MIN(LO, LO.1)

Then the resulting equations for Pivot Point and 1st Support and Resistance would be:

Pivot Point: (HI.1 + MIN(LO, LO.1) + CL.1) / 3

1st Support: 2*PP - HI.1

1st Resistance: 2*PP - MIN(LO, LO.1)

Another option subsequently added to the Pivot Point study allows for the viewing of historical daily pivot levels on intraday charts. When the "Use Daily" options is selected, you can then specify how many bars back you would like to base the calculation of your pivot levels. For instance, if you chose 1 bar back, you would see yesterday's pivot levels. Conversely, if you specify -1, you would see tomorrows pivot levels. You will only be able to view tomorrows pivot levels if you pivot level calculations do not rely on the current days data (only previous days data). This historical option also works with weekly and monthly options.

The following custom indicators can be used to represent the 4th and 5th support and resistance levels.

S4: (HI.1 + LO.1 + CL.1)/3 – (2 * HI.1 – 2 * LO.1)

S5: 2 * (HI.1 + LO.1 + CL.1)/3 – (3 * HI.1 – 2 * LO.1)

R4: (HI.1 + LO.1 + CL.1)/3 + (2 * HI.1 – 2 * LO.1)

R5: 2 * (HI.1 + LO.1 + CL.1)/3 + (2 * HI.1 – 3 * LO.1)

Once these custom indicators are created, they should be added to intraday charts using the MPD (Mixed Periodicity Data) indicator (one for each custom indicator). Setup MPD with "Mix Periodicity: Daily", "Data Source: Indicator: CI: Custom Indicator" (and choose one of the custom indicators you've created), and "Stretch" should be checked.

These 4 support and resistance levels have more concise formulas if you use the MID and HLR tokens. MID.x is equivalent to (HI.x + LO.x + CL.x)/3. The HLR (High Low Range) token HLR.x is equivalent to (HI.x - LO.x). Thus we have:

S4: MID.1 - (2 * HLR.1); S5: MID.1 - (2 * HLR.1) - HI.1; R4: MID.1 + (2 * HLR.1); R5: (2 * MID.1) + (2 * HLR.1) - LO.1

Presentation

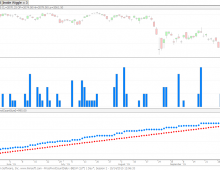

Above is a 5-Minute Chart of an Intel Corporation (INTC) . The five colored reference lines represent the pivot point, 1st and 2nd support, and 1st and 2nd resistance levels.