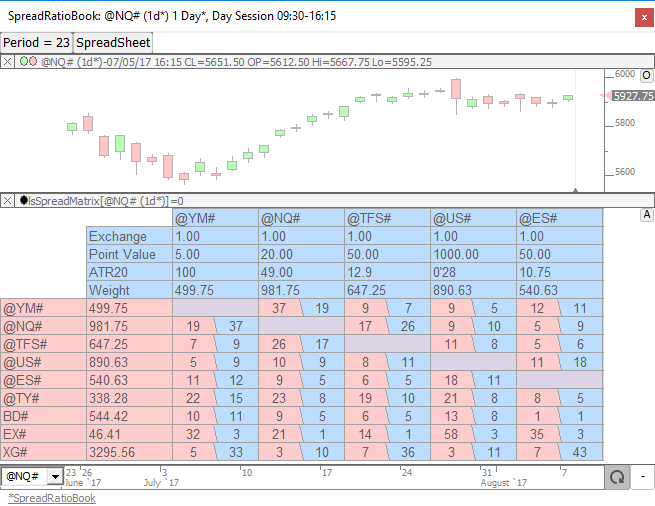

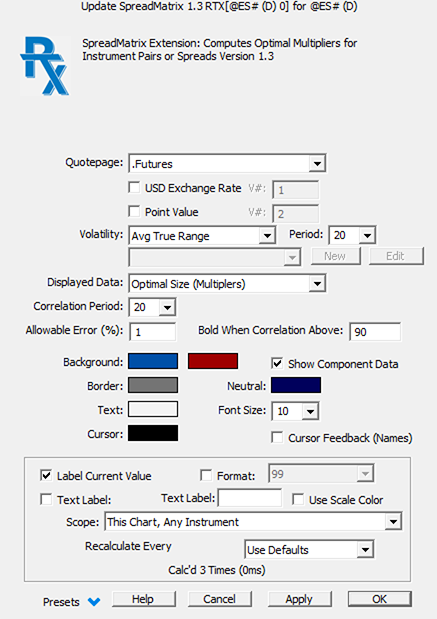

The Spread Matrix RTX extension is designed to automatically compute the optimal number of contracts or shares for each component of a spread or pair. For example, the Spread Matrix may recommend trading 11 contracts of ES against 6 contracts of NQ when trading an ES-NQ pair in order to maintain a good balance between the 2 (or some multiple of the 11 and 6). The calculation takes into account the volatility, point value, and (optionally) exchange rate of each instrument.

By default, the volatility is computed as a 20 period Average True Range of the charted periodicity in which the Spread Matrix resides (commonly daily bars). While the ATR option is generally a suitable reflection of volatility, a custom indicator option is available to supply the volatility which opens up the calculation to a great deal of flexibility. By default, an exchange rate of 1.0 will be used for each instrument, but an option is also available to supply the exchange rate of each instrument via a user variable (V#). For example, while the ES and NQ would use an exchange rate of 1.0 since their point value is expressed in USD, instruments like the BUND and STOXX might have an exchange rate of 1.19 reflecting that one Euro has a USD value of $1.19 (which can be obtained from the Euro FX futures instrument: @EU# / 6E). To supply the Exchange Rate manually, simply check the Exchange Rate checkbox and supply the V# number in which it is stored. Add the corresponding V# to the quotepage and manually enter the exchange rate for each symbol. The Point Value represents the value of each 1.0 point move of the underlying instrument. This value is automated by Investor/RT and will rarely if ever need to be supplied manually. However, if that need arises, there is a checkbox which allows supplying the Point Value via a V# in the same fashion as the Exchange Rate. The Allowable Error essentially controls how closely the weighted values of each instrument must be when computing the multipliers. A recommended value for Allowable Error is 1.0% with higher errors resulting in lower multipliers while smaller errors will result in a more tight matching but larger multipliers.

Presentation