Much of the documentation for Investor/RT is written from the perspective of the Windows version of the software. There is frequent mention of the Alt key, the Ctrl Key and the Delete Key. These are keys typically visible on Windows PC keyboards. On Macintosh PC's the keys are labeled differently (Think Different, as the Apple slogan goes).

The Alt Key is called the Command key on Macintosh keyboards. The symbol on the key typically resembles a cloverleaf. Long time users of Macintosh PCs will remember the days when this key was called the Apple key.

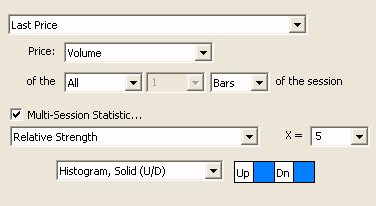

This be done with the Session Statistic Indicator

As an example, if you setup Session Statistics like the below:

Painting the Overnight Session Background

Yes, here is a video explaining just that.

To view as text, select the Profile Indicator by clicking on the containing rectangle (of the right-most profile). If you don't see the volume at price data when selected, you'll need to zoom in vertically using the shift-scroll wheel. When zoomed to a level where there is space for the text, the text should appear.

To export the volume at price data, right click on the containing rectangle of the profile and choose "Export Data".

Price labels are drawn using the font size selected for the scale. The scale font defaults to "small" by default. To view the font size for any scale, double-click in the price scale area at the right of the pane. The font size options are small, medium, or large.

If you would prefer that all price labels be drawn in small font, regardless of the scale font setting, go to Setup > Configuration and set the variable

LargePriceLabels=false;

If the trade occurs at or above the ask price, it is considered a buy (ask volume). If the trade occurs at or below the bid price, it is considered a sell (bid volume).

If a trade occurs at a price between the bid and ask price, then by default, the following logic is used. If price just moved up on this trade or the previous trade, it's considered a buy. If price just moved down on this trade or the previous trade, it's considered a sell.

When a futures symbol rolls over to a new contract, a gap is created at the exact time of the rollover.Looking at a specific example, below is a chart of the continuous contract the S&P mini contract (@ES# using DTN IQFeed). This continuous symbols follows one contract right up until the time of rollover, then immediately switches to follow the new front-month contract.

The TPO Indicator can be used to plot lines for the developing VPOC as well as the developing VAH and VAL. The preferences below were used to result in the lines seen in the chart at the bottom of this page. Be aware that this indicator uses a little more memory than most indicators so try to use it on charts with smaller view periods (last 10 days or less) if to minimize the memory requirements (although adding it to a "last 100 days" chart only takes 6mb of memory, so if you have plenty of memory, not a concern).

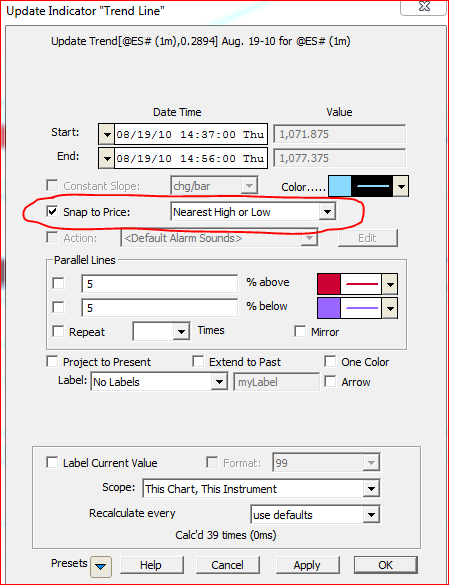

Yes, simply setup the Trendline with "Snap to Price: Nearest High or Low" as seen in the trendline preference window below. This option is the first option in the drop down list box. When trendlines are setup in this fashion, they will snap to the nearest high or low of the bar to which they are dropped or dragged.