- Forex Trading often requires a Boundless Session that starts and stops at the same time. To set this up, first you must enable Boundless Sessions by going to File > Preferences > Configuration and searching for the Configuration Variable called AllowBoundlessSessions. Set this to True. Then go to File > Preferences > Sessions and create a new session with the same start and stop time.

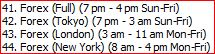

Below are the market hours for Forex (US/Eastern).

The highest volume / most activity is found during the periods where the markets overlap (seen below). For this reason, these periods are generally considered the best times to trade.

- New York and London Overlap — 8:00 am to 12:00 noon ET

- Sydney / Tokyo Overlap — 7:00 pm to 2:00 am ET

- London / Tokyo Overlap — 3:00 am to 4:00am ET

The three largest markets are generally the three that are focused on: London, New York, and Tokyo. The US market (NY) trades runs from 8am to 4pm ET. To create a single session which spans all three markets, use: 7pm to 4pm Sun - Fri (see below). Adjust times to according to the time zone of your computer clock. Tokyo opens the week on Sunday evening at 7pm ET and the week finishes at 4pm ET Friday with the closing of the New York Market. Create that session (Setup: Preferences: Sessions) with these times and assign it to any Forex symbol and to any charts for which you'd like to view the full session. You can then create more session for each individual market and assign those to charts if you'd like to limit any chart to one specific market. You might end up with 4 sessions named: Forex (Full), Forex (Tokyo), Forex (London), and Forex (New York), as seen below.

- The number of the session will vary for each user and is not important. The session times/days if the important part.)

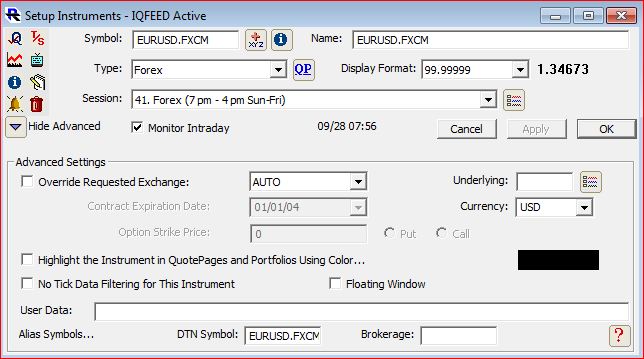

The Forex symbol should also be setup with display format 99.9999. Here is an example of the symbol setup for a common Forex symbol (DTN IQFeed):

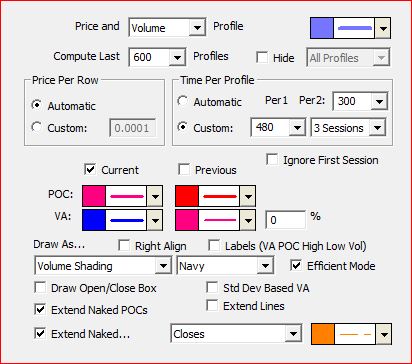

To setup the Profile Indicator to create separate volume- or time-based profiles for each of the three sessions, yet give full consideration to the US session. The user would setup the Profile Indicator as follows, setting Per 1 to 480 (minutes for the Tokyo market, 8 hrs, 7pm to 3am ET), Per 2 to 300 (minutes for the London market, 5hrs, 3am to 8am ET), with the remaining 480 minutes being allocated to the New York market (8 hrs, 8am to 4pm ET). Some users may choose to increase Period 2 (360, 420, 480, 540) to give more hours to London/Europe market and less to New York/US Market.

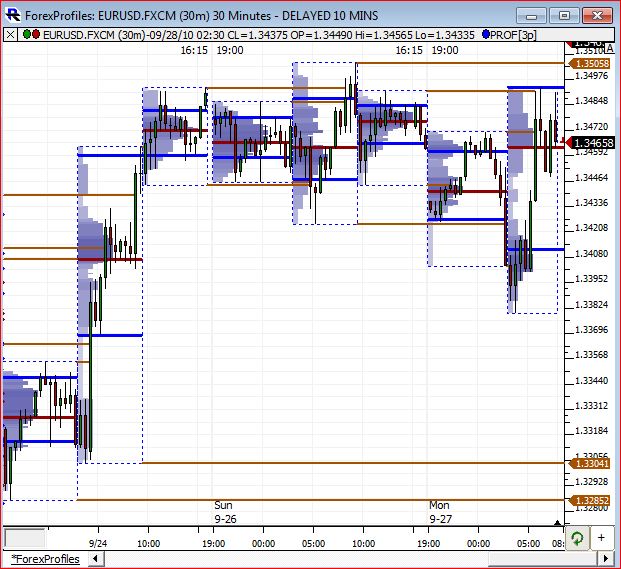

Here is an example of what those profiles will look like:

Price movement is not a reflection of last trade.

Each trades or tick is actually just a change in the bid or ask price (or both). The price attached to each trade/tick in Investor/RT is the bid price since only a bid and ask price are provided (no last price with each tick). And each trade/tick is given a volume of 1. For this reason, volume is not a reflection of contracts traded, but number of times bid/ask changed (which is in turn a reflection of volatility). For this reason, volume on Forex must be viewed differently than that of other markets. While Forex volume is not as accurate as true volume, it still is representative of activity at each price at within each bar and can be of value to traders. Consequently, all advanced profile features of InvestorRT can be applied to the Forex markets, as highlighted in this dynamic zigzag profile charts

https://www.linnsoft.com/charts/ef-forex-dynamic-zigzag-profile-eurusdfxcm

Reminder : To display Forex instruments in InvestorRT, subscribe to the DTN IQ feed FOREX package (also available as a standalone service). IQFeed provides access to the following list of 45 FXCM Forex pairs and 1500+ pairs through Tenfore