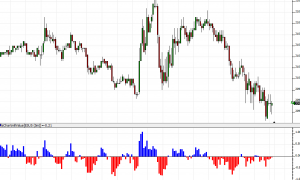

Clear (RTX)

The Clear RTX Extension is an implementation of the Clear Method, a method for determining short term swing direction, described by Ron Black in his 2010 article in Stocks and Commodities Magazine titled Getting Clear With Short-Term Swings. The indicator can be plotted on any timeframe. RTX Clear produces a color coded output line showing the current swing direction and produces a signal on any bar when the direction reverses. During an up swing, if price penetrates (clears) the highest low of the move, the swing remains intact, otherwise a down swing begins.