Volatility and Black-Scholes Calculation

See Also... Setting Up an Options QuotePage - Options Analysis Values Defined

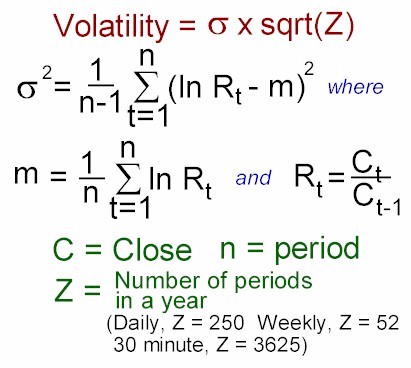

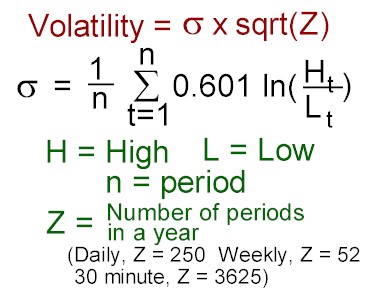

Throughout Investor/RT, there are two methods to choose from when computing volatility: The Close-to-Close Method and the Extreme Value Method. The Close-to-Close Method compares the closing price with the closing price of the previous period, while the Extreme Value Method uses the full range of highs and lows. The method used, along with the number of periods used in the calculation, and the periodicity (duration of each period) may be set by the user in the Options Analysis Preferences. The volatility is then used in computing the theoretical value of the option using the Black-Scholes equation. The theoretical value can be added to a quotepage which contains options.

Close to Close Method  Close to Close Method

Close to Close Method

Extreme Value Method  Extreme Value Method

Extreme Value Method

Black-Scholes Formula

C = Theoretical Value of the Option S = Price of Underlying Stock L = Strike Price s (sigma) = Volatility of Underlying r = annualized rate of return for a risk-free portfolio t = time (in decimal fraction of a year) left in option N( ) = Stardard Normal Function