Investor/RT allows the user to create Custom Instruments which reflect some arithmetic combination of other instruments. The feature can be used for tracking the spread between two instruments or tracking the value of a basket of Securities, a Portfolio or a Mutual Fund.

Investor/RT allows the user to setup user-defined instruments which are defined as:

- The weighted sum of one or more instruments, called the component instruments.

- The weighted difference between any two component instruments.

- The weighted ratio of any two component instruments.

Since the components themselves can also be Custom Instruments, arbitrarily complex calculations are possible.

For users with a real time feed, each Custom Instrument is recalculated each time any of the underlying components of the Custom Instrument changes price. User defined instruments are also recalculated automatically whenever quotes on the underlying components are downloaded.

Custom Instruments have all of the properties of exchange fed: they may appear in quote pages, charts (any time frame), quick quotes, trading notes, or have indicators built based on their values.

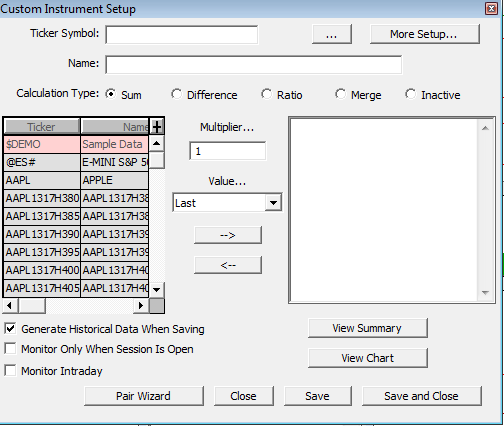

To create a Custom Instrument, open the Object Manager by going to File → Open → Object Manager or Alt-O. From the Object Types list on the right, select Custom Instruments. A list of your current Custom Instruments will appear on the left. To create a new Custom Instrument, double click the words "Custom Instrument" or press New. This will open the Custom Instrument Window as shown here:

Setup your Custom Instrument

In the Ticker Symbol Field, enter a custom symbol to be used for the Custom Instrument and be careful not to use the symbol of an existing exchange Instrument. Optionally, you may name your Instrument in the Name Field.

Then choose your Calculation Type. You may Sum many instruments, calculate the difference or ratio between two instruments, or Merge Instruments.

Choose the components from the instrument selector. Double-clicking adds the component to the component list on the right using the multiplier currently in the multiplier box. The default (and most common) Multiplier and Value are 1 and "Last" respectively. Negative Multipliers are allowed. To change a multiplier after adding a component, select the component from the list on the right and enter a new multiplier. This will turn the top arrow into a Modify button that you can press to save the modification.

Choose the options in the bottom left corner and then press Save and Close when finished.

It is recommended that you first download tick data for all of the component Instruments and then download tick data for the Custom Instrument. Although Investor/RT is technically not downloading data from the Custom Instrument from an exchange, Investor/RT uses precise date/time synchronization during this process to generate an accurate Custom Instrument, even when the time series of each component do not completely overlap or when there are gaps in the time series of one or more of the components. The generated historical data will begin with the first date/time that all component instruments have in common for the desired periodicity. Generation will proceed forward in time to the current time based on the periodicity specified. The “session” of the custom instrument is used to determine the time span of each day’s trading when producing historical bars.

The instrument selector has some features that may be of interest when working in the Custom Instrument Setup window. If you right-click on the ticker or name column title in the instrument selector, a popup menu appears for changing or refining the list of instruments in the selector. You can, for example, choose "Show Futures" and the instrument selector will refine the list to just Futures. If you double-click on any custom instrument ticker in the instrument select, the definition of that custom instrument will be displayed in the setup window. Double-clicking on an custom instrument is equivalent to single-clicking to select a custom instrument and then clicking the “Select” button. Thus you can double-click on any custom instrument and then click view chart to see both the definition and chart window.

Pressing the button View Summary text window showing the formulas for all of the Custom Instruments defined to Investor/RT. Here is a sample:

Custom Instrument: Testing 456, Session 6 TEST456 = 5.41522 MSFT+ 0.577433 CA+ 7.33491 CSCO+ 0.331131 NTAP+ 0.48169 Custom Instrument: My Index, Session 6 MYINDEX = ADBE+CA+COMPX+CSCO+IBM+IP+JNPR+MSFT+NEWP+NTAP+ORCL+QQQ+SBUX+T+VNO Custom Instrument: Ratio plus a constant, Session 6 CAIBM = 4 CA+IBM+ 15.5 +INDU(lo) Custom Instrument: Focus Stock Index, Session 6 $FOCUS = ADBE+CSCO+ORCL+QQQ+IBM+T+CA+MSFT+SBUX+VNO+JNPR+NTAP

Note that multipliers of 1.0 are implied when the multiplier is not shown. A number followed by a ticker means that number times the price of that ticker. The Last price is implied if the ticker is not followed by a price indicator, i.e. INDU means the last price of INDU while INDU(lo) means the low price of INDU. When the price indicator is 1.0, the multiplier becomes a constant so its value is listed in the formula without a ticker. See the third example above.