Investor/RT Version 12 and higher adopts the convention that the size of the range or change of each bar be expressed as the number of tick increments of range or change. In Version 11, range/chart bar periodicity has been expressed differently, as the number of prices within the range bar, a number that is one greater than the number of tick increments in the range.

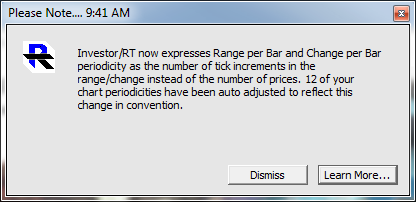

Upon upgrading to 12.1 or higher, Investor/RT will automatically search for and adjust the periodicity of any charts and trading systems that call for Range or Change Bars. If you have one or more charts/trading systems using this periodicity, you will be notified at startup of the action taken:

Range Bars

How it works in Version 11

In version 11, to view a 1-tick increment range chart, you have to enter a value of 2 ticks into the periodicity window, 2 being the number of prices in each range bar. As price oscillates between the two prices, that are 1 tick increment apart, the range bar continues to form until a trade occurs at some third price.

How it works in Version 12

Version 12 uses the more widely adopted convention of specifying the range as the actual number of tick increments of range. A 1-tick range bar periodicity forms bars where the actual range (the high minus the low of the bar) is exactly 1 tick increment. Notice that a 1 tick range bar in version 12 is equivalent to a 2 price range bar in Version 11, i.e. the range bars reflect trading that oscillates between two price that are 1 tick increment apart.

Change Bars

A Range Bar periodicity produces bars of equal range. Similarly a Change Bar periodicity produces bars of equal change, where change is defined as the positive price difference between current price and the open price.

How it works in Version 11

In version 11, a 2-tick change bar periodicity would produce bars having no more than 2 prices: the open price and a second price a tick increment above or below the open. For example, the S&P Emini contract opens at 1800.00; the change bar would continue to form as long as trading was between 1800.25 and 1799.75. Any price outside that would mean 3 prices (the open price plus 2 prices above or below it), thus a new change bar would begin when that new trade occurs.

How it works in Versions 12

Using the S&P Emini contract with a tick increment of .25 as an example, a 2 tick change bar means that new change bars begin when price strays greater than two ticks from the open of the bar. For example, the S&P Emini contract opens at 1800.00 and oscillate between 1800.50 and 1799.50 without creating a new bar. A break above 1200.50 or below 1199.50 would cause a new change bar to begin.

The Bottom Line

Version 12 expresses range bar and change bar periodicity with a tick count one less than Version 11. The version 12 convention conforms to the way range bars are expressed in other widely used charting platforms. This revision is aimed at providing consistency for new users coming to Investor/RT from other platforms. Educators, 3rd party developers, and consultants whose activities give rise to the use of range bars and change bars will no longer have to cite Investor/RT as an exception to the norm.