Reminder: What are the futures contract settlement prices ?

On futures markets, settlement prices are the official closing prices for futures and options contracts, reflecting the fair market value at a specific point in time, typically the end of the trading day. These prices are used for daily marking-to-market to calculate profits and losses, as well as to determine final contract values and margin requirements.

For each market, daily settlement prices are determined by the exchange based on trading activity, often as a volume-weighted average price (VWAP) during a designated settlement period, knowing there is also a special procedure to determine the final settlement price (ie the one taking place at the contract expiration)

How is CME determining the daily settlement prices for US E-Mini equity indexes?

The procedure for equity indexes is explained in this CME notice

Today, the settlement price is basically a VWAP computation of the last 30 seconds of the daily cash session, ie the VWAP of all trades executed from 2.59.30 to 3.00.00 pm (Chicago time)

It was last modified in September 2020, following the termination of the big S&P contract pit trading activities (in March 2020). Indeed, the 30-second calculation period was previously taking place (for all CME main equity indexes) from 3.14.30 to 3.15.00 Chicago time, with 3.15 pm being the former Pit session closing time.

An example: the settlement price of the E-Mini S&P500 Sept. 2025 contract on August 21st, 2025

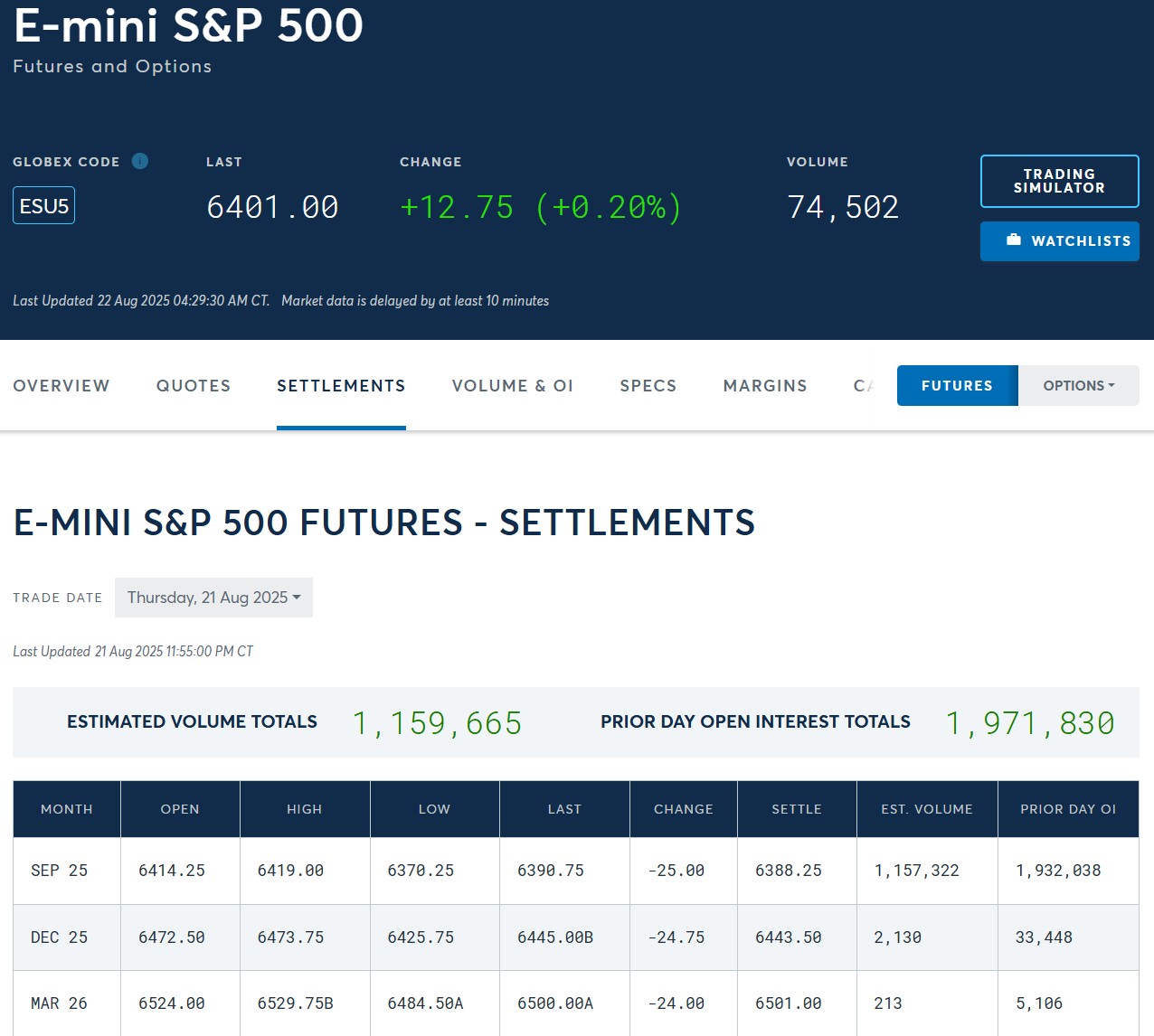

You can check the ES daily settlement prices on this CME webpage. Here is the screenshot of this page, after the closure of the market, on August 21st 2025:

On that date, the official settlement price (as reported by many institutions) was 6388.25.

To be 100 % precise, the Open, High, Low and “Last” columns on this table are determined as per the full Globex session hours, ie 6390.75 was the last trade executed, just prior to the daily Globex session break at 4 pm (Chicago Time).

Note: on rollover day, the "rollover premium" (used to do the back-adjustment for continuous contract) is the difference between the settlement prices of the 2 consecutive quarterly contracts (the one about to become the front month and the one about to expire)

How to access Settlement prices in Investor/RT ?

1) Through the RTL Token “SETTLE”.

This RTL token will always reflect the Settlement price of the last completed session. It is not a “historical” token, i.e. it will always return a single value, i.e. the last known settlement price. (The Settle token is not available when using CQG as live datafeed)

2) By accessing the Close price of the “Daily” Bar data

Please review first this support page to clearly understand the difference between “Daily Bar Data” (ie a single set of OHLCV values received from the data provider) and the “1day*” periodicity, which represents daily bars built from tick (or 1 min) data

If you have an Investor/RT daily chart for the ESU5 contract, the Close price of your daily candle will reflect:

- The Close of the Globex session (ie 6390.75) if you are using the 1day* periodicity (ie daily bar built from intraday data ) and if your “chart session” is set to the full Globex session

- The Settlement Price (ie 6388.25) if you are using the “Daily” periodicity

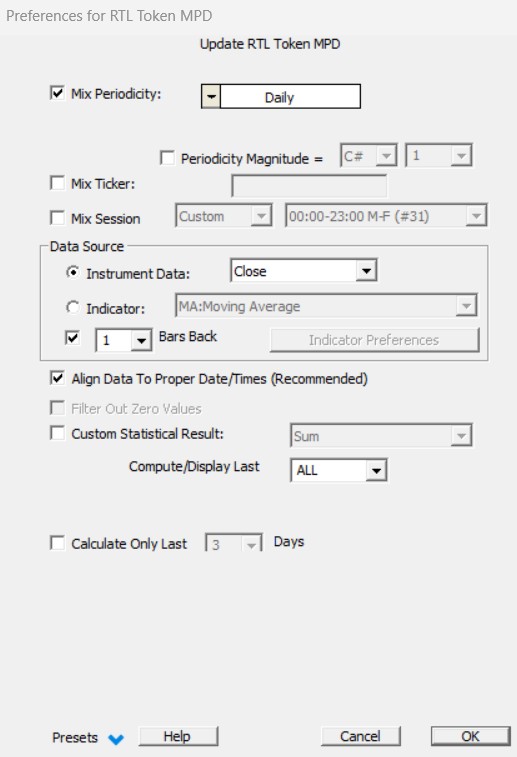

To access the settlement price on any intraday charts (ie a 1 min chart or any non-time-based bar periodicity), one will typically add the MPD indicator (or rely on a custom indicator using the MPD RTL token) with the following MPD settings