Introduction

This support page introduces the important Investor/RT concepts to be aware of when managing instruments (especially during the rollover procedure) and possibly customising some individual settings (Instrument data Monitoring & Retention, Day Session hours, etc.).

To check the setup of a symbol, access the corresponding instrument settings window through one of the following ways:

- Press Alt-A to open the Instrument Setup window (and type the Symbol) OR

- From any Chart: right click anywhere and select the menu Setup > Instrument OR

- From any Quotepage: right click “ticker” column on the cell with the symbol and select the menu Setup > Instrument

The future symbol you will be using in Investor/RT should always match the symbology determined by your specific live data source, ie IQ Feed, Rithmic, CQG or IBKR. Please refer to our symbol guide if you are not familiar with the data provider nomenclature, or use our rollover calendar page to quickly identify the current front-month future contract.

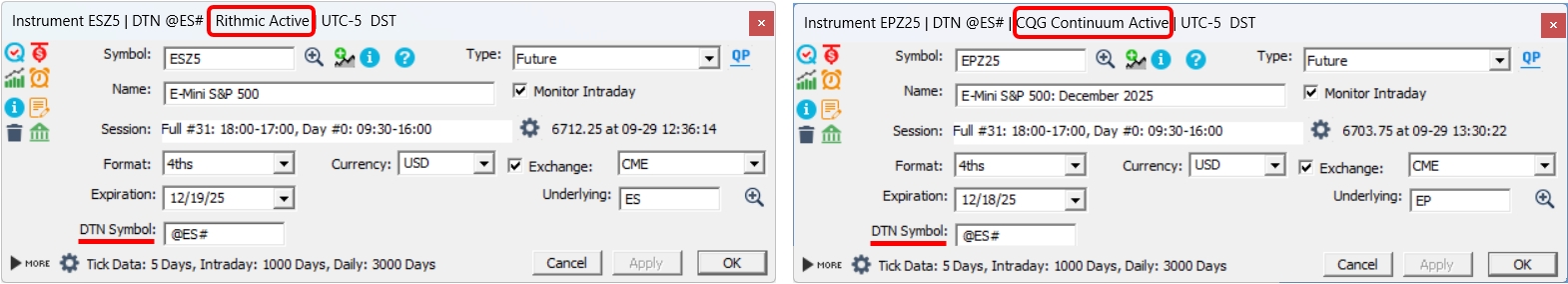

Typical instrument setup with a broker feed (Rithmic, CQG or IBKR) and with a DTN MA subscription

The following screenshot reflects the settings for the E-Mini S&P 500 contract expiring in December 2025 for an IR/T user located in the Eastern Time Zone, with a Rithmic (resp. CQG on the right) data feed configuration.

Please note the following information, which are summarized in the title banner of the setup window

- the instrument Symbol (respectively ESZ5 / EPZ25)

- the corresponding DTN continuous contract symbol: @ES# is the continuous S&P 500 E-mini contract, back-adjusted for rollover premium, which will be used to perform any historical data backfill

- the current status of the Rithmic / CQG datafeed (Active / Inactive)

- the timezone of the computer clock (this timezone should always match the timezone settings as it appears in the Session preferences menu)

If you monitor the front month symbol (ESZ5) and use the continuous contract as "downloading alias", Invesior/RT will effectively "transform" the ESZ5 time series as a continuous symbol, ie

- the quotes since the last ES rollover date will reflect the transaction corresponding to the Z5 contract

- any quotes prior to the September to December rollover date will correspond to the continuous contract, not to what the ESU5 contract might have traded before it became the front month contract.

This behaviour can only be achieved with the front-month contract. Assuming you already want to monitor the ESH6 future (while it is not yet the front month), you would have to use as DTN (downloading) alias @ESH26 and not @ES#

Please review the Continuous Contract support page if you are not familiar with this concept (and to learn when you might need to modify this setting).

It is important to understand that all the other future contract characteristics (Display Format / tick increment, currency, Sessions, etc) are derived from the default settings available in the "Future Type" library of Investor/RT

Remark: due to the additional symbol identification parameters required by Interactive Brokers, the instrument settings for IBKR futures are slightly different and discussed at the start of the IBKR symbol guide page

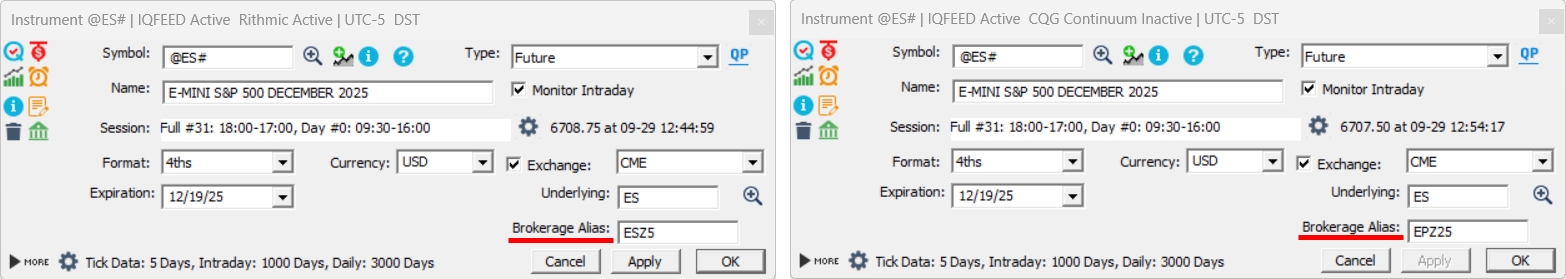

Typical instrument setup with IQ feed as a live data source

This screenshot displays the same symbol settings (ie the E-Mini S&P 500 contract expiring in September 2025), but for a user with an IQ feed live data subscription and executing orders to a Rithmic account.

With an IQ feed subscription, one should notice the following differences in this setup window :

- It does not include any Downloading Alias, as the main DTN symbol is always used as a reference for both live data streaming and for any historical data backfills.

- On the bottom right corner, it includes a "Broker Symbol" input box. During the configuration phase, if an IQ feed user has opted to execute orders through one of the supported order execution systems (Rithmic or CQG), the corresponding Broker symbol must be manually entered in this setup window (or by modifying directly the content of the "Broker Symbol" column on any QuotePage). The selected brokerage destination will always show up in the window title banner, which will highlight the Active/Inactive connection status of both datafeed

Note: If you use @ESH25 as DTN symbol on a chart (instead of @ES#), you display effectively all the transactions corresponding to that contract (with, in fact, very low volumes prior to Sept. 2025). The vast majority of IQ feed users will directly use the @ES# continuous contract symbol as the primary instrument through all their charts and quotepages. This way, other than doing a full data download, at the DTN rollover date, their rollover procedure will mainly consist of updating the broker symbol (associated with @ES#).

While there is no reason to change some of the fundamental future contract specifications (format, currency, exchange, expiration date, etc), we discuss below the other instrument settings, that may be of interest when running Investor/RT on a daily basis, ie the full and day sessions hours settings, the intraday monitoring status and the historical data retention settings.

Full and day Session settings

Here are the key things to know about sessions in Investor/RT:

- I/RT comes with a list of predefined sessions that can be managed in the "Session preferences" menu

- For a given market, the full session hours dictate the period of the day for which Investor/RT will collect quotes from the data source: it should therefore typically match the market opening hours. (Typically, for most of the US futures, this corresponds to the whole Globex session, running from 6 pm to 5 pm ET)

- Over the years, I/RT has developed a full toolkit of unique indicators (Session statistics, Session Prices, Mixed Periodicity Data, etc) designed to generate key market levels and statistics that do rely on the defintion of a "day session", typically reflecting the cash market session hours for Equity indexes futures, or former pit trading hours for commodity (Oil, Gold, agri products) or financial futures (Bonds, etc)

- Within the Session preferences window, a given Full Session # can be associated with a (single) Day session. This is how a Day Session is defined for a given instrument.

You will find additional information in the Sessions 101 support page, including the full and day session hours being used by default for every pre-defined future contract in Investor/RT. If you are a new user and have recently performed a fresh install, ie using the "Starter database" shipped with 16.1 beta 10 (or a later release), then you are ready to go..

Important note for existing I/RT subscribers: you may have set up an instrument using another session # in the past. What is essential is not the session numbers themselves, but that you use a set of relevant full & day sessions for a given symbol, ie a full session that does match the market opening session hours (for making sure you collect all the transactions and a day session that fits your specific market analysis needs.)

The instrument's "intraday monitoring" status

Each instrument has an on/off "intraday monitoring" status. When a symbol is marked for intraday monitoring, it has 2 main consequences :

- When you start Investor/RT with the default setup (ie both configuration variables AutoConnectToData and BackfillAutomation set to true), IRT will download all missing data that may have been traded on the market (since the last time I/RT was running), corresponding to the list of instruments being monitored intraday (independently from any chart or Quotepage including that symbol being open).

- Once you are connected to your datafeed (either IQ Feed or a brokerage data feed such as Rithmic) during your trading session, Investor/RT will continuously monitor that symbol tick by tick, i.e. collect and retain the corresponding tick data, even if you have currently no chart open (displaying that symbol) or a Quotepage open that rerquire the monitoring of that symbol.

Consequences: If you open a new chart or switch your existing chart to a monitored instrument, it will immediately update, as there is no need to perform any kind of download. If you open a new chart for an instrument not tagged for intraday, the initial backfill/data download will take place when you open the chart (not when you started your data feed).

To summarize: for your regularly traded markets, make sure the corresponding symbols are tagged intraday (this is most likely the case as this is the default settings), for the other ones that you may have opened once, or that you don’t need to monitor, they can be untagged, as easing the load on your computer CPU and RAM is always welcome: no need to maintain a live monitoring of millions of ticks you have no use for!

Please check the Instrument Monitoring Status support page to know how to easily identify the symbols being monitored and about the different methods to turn on/off intraday monitoring

The historical data retention settings

Here are the different ways to access the data retention settings for tick data, intraday data (1 min bar) and Daily data:

- Press Ctrl+H to open the Instrument Setup window (and type the Symbol) OR

- From any chart: right click anywhere and select the menu Setup > Historical Data retention OR

- From any Quotepage: just add the "Retain TickData", "Retain Intra" and "Retain Daily" columns (by right clicking on any column title and selecting "Add Column")

The first 2 options will open the Historical Data Retention preferences settings window, where you can adjust either the retention settings for one instrument or the overall default settings. Having a quotepage with All symbols and the 3 "Retain" columns is a convenient way to have a quick overview of all retention settings (you can modify directly one value by editing/adjusting a number within the corresponding quotepage cell)

Data retention settings determine how long the software stores historical tick, one-minute, and daily bar data for tracked symbols. Users can adjust these settings globally or on a per-symbol basis. This allows for flexible management of disk space and data availability. The default settings (from I/RT 16 onwards) are 5 days for tick data, 1000 days for 1 min data and 3000 days for daily data.

With the current 64-bit infrastructure, there are no more limitations on the size of the quote database within Investor/RT. Still, the (global) tick data retention setting is voluntarily set by default to a low number (ie 5 days) as it is highly recommended to increase it on a case by case basis (and not on a global way that would apply to any instrument). If you need a chart with a 3-month lookback period and a non time based periodicity (such as renko or range bars) that requires tick-by-tick data, then the Retain tickdata settings should be increased accordingly. Whenever you adjust such retention settings, a full data download operation needs to be performed

The Downloading and Retaining data support page provides more details about data retention settings and to understand the difference between a full data download and other custom download operations, knowing that, on a day-to-day basis, all necessary data backfill operations needed to keep your charts or quotepages updated will be performed by I/RT automatically without any user intervention.