This support page discusses how “Full Session” and “Day Session” are being defined in the instrument setup window, which is important to know when later used within specific indicators (Session statistics, Session Prices, Mixed Periodicity Data etc) for generating key market levels and statistics. Sessions are also used as key input for selecting chart display viewing periods.

Important notice :

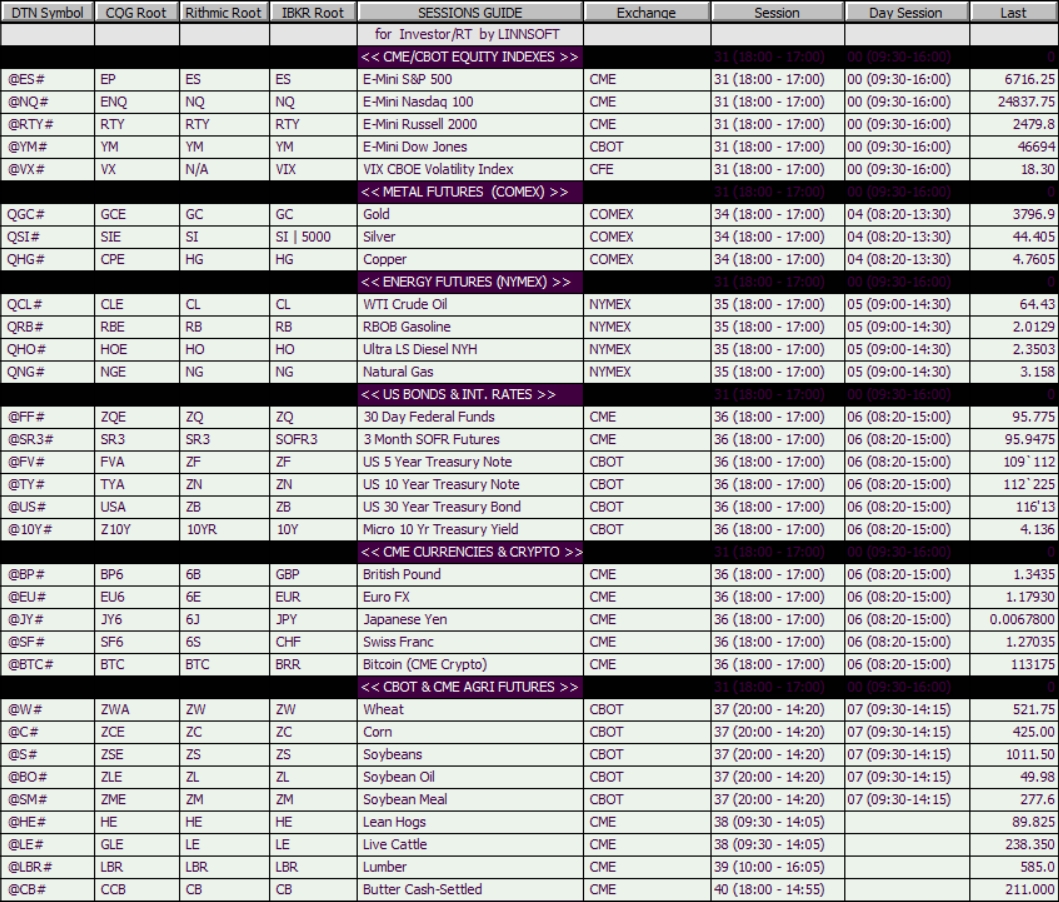

Investor/RT includes a list of pre-defined individual sessions that can be managed through the Session Preferences menu (File > Preferences> Sessions). The table highlighted in this support reflects the predefined full and day sessions hours, with the corresponding session numbers as available from Investor/RT 16.1 beta10 onwards.

If your I/RT fresh install was performed with an earlier version, you do have a different set of session references #, with session names and numbers you may have customized yourselves. The number of the sessions themselves is not essential; what is important is that, within your instrument setup windows, the pair of full and day session hours is correctly defined in your instance.

Part 1 - Full and day sessions within the instrument setup

1.1) Symbol “Full session”

For a given market, this is the most crucial reference as it dictates the period of the day for which Investor/RT will collect quotes from the data source. This full session should therefore typically align with the market's opening hours.

Since 2020, most of the US futures markets (Equity Index and currencies, US Treasuries, Energy and Metals futures) will trade as per the most recent Globex session hours, ie from 6.00 pm to 5.00 pm Eastern Time (the main exceptions being the Agricultural products)

1.2) Symbol “Day session”

Defining a day session within an instrument setup is not compulsory within I/RT, but strongly recommended to benefit from the multiple indicators (Session Prices, Session Statistics, MPD, charts button, etc) that do rely on the generic “Full” and "Day" Session references.

Within the Session preferences window, any Full Session # can be associated with a specific Day session. This is how a Day Session is defined for a given instrument. Please note that having a Daysession defined (even if you don't intend to use it) won't have any negative impact on your day-to-day charting and analysis activities

When considering any adjustment in full and day session settings, please keep in mind note 3 important facts:

- Only a single Day Session # can be linked with a given (Full) session number. This is why IRT now offers, by default, different session numbers (31 to 35) that all match the same Globex session hours, but are associated with different day session hours.

- A given Session # can be used as a day session for different full sessions. For example, Session #00 can be simultaneously used as the “Day Session” for both the full session of the Nasdaq stocks (Session #01) and of the US Equity Index futures (Session #31).

- Timezone wise, your PC and Investor/RT Session settings should always match. Session hours are defined according to the Timezone settings , which can be found in the File > Preferences > Sessions menu. If both settings aren't similar, you will get a warning message from I/RT at startup. However, if you are travelling and want to keep your usual session hours being displayed within I/RT, just adjust your PC clock (so that it stays synchronized with your home address) - The table below will highlight default session hours as per Eastern Times.

1.3) Comments about Overnight, Pre and Post-market sessions

Some Investor/RT indicator may refer to an “Overnight session” (Paint Bars, Session Statistics, Session Prices,..) By definition, this “Overnight session” (even if it doesn’t appear in the Session Preferences list) is always defined as the period starting with the first start of the Full session and ending with the last trade completed before the start of the Day session (as defined in each instrument setup window)

Similarly, some indicators may refer to “generic” pre- and post-market sessions. The premarket session is, in fact, identical to the Overnight Session, while the postmarket session covers the trade taking place after the close of the day session, until the close of the Full session

Part 2 - Using a specific session as a Viewing period for a chart

In the "chart session" hours pop-up list (available in the Chart preference settings window, which can be accessed through CTRL+N or the right-click / Setup menu on a chart), I/RT will automatically display every session that is a subsession of the full session of the main instrument of the chart.

Practically speaking, the most commonly used options are either the Full Session, the Day Session, the Overnight session or any other relevant subsession (of the Full Session)

If you frequently switch between sessions, you will likely use the “Change Session” button on the Chart Button: the Full and Day sessions can be identified with the generic “Full” and “Day” while any other sessions would have to be identified with the corresponding Session number.

This way, whenever you change the instrument of the chart (from ES to DAX to FTSE) with such a button to Full or Day, you don’t need to indicate the precise session number corresponding to that instrument. The chart will adjust automatically to the Full and Day sessions as defined in the corresponding instrument definition.

Part 3 – Investor/RT default session settings for the main futures traded on the CME exchanges

Comments about Investor/RT session settings for the CME futures

There is no right or wrong choice when it comes to defining a Day Session, especially for the US equity markets.

Quick reminder about the US Globex session: prior to 2020, the daily Globex “break” was taking place from 4.15 pm until 4.30 pm (ET), providing a very convenient way to split the whole electronic trading session into 2 sessions, i.e. an overnight session from 4.30 pm to 9.30 am and a day session that was matching the former pit session hours of the (now disappeared) "big" S1P and Nasdag contracts, ie. from 9.30 to 4.15 pm.

With the daily Globex session close having shifted to 5.00 pm ET, the pit having been closed, and the settlement time set at 4 pm ET, this created a third (odd and short) trading period from 4.00 to 5.00 pm ET.

Some indicators, such as the Volume Profile, can split a full Globex session natively into three periods. However, if you want to keep simple market levels reference and/or statistics (and still split the full session into 2 separate sessions), you might want to use what we refer as the “Extended” Day Session, ie a session starting from 9.30 am to 5 pm ET, which basically merges the cash session together with this last hour of trading (before the daily Globex break).

Due to the fact that a single Full session number can only be associated with a single session (as explained earlier), we have created different Full sessions (Sessions #30 to #36) that all match the Full Globex hours (6.00 pm to 5.00 pm ET), but are associated with different Day Sessions.

Review of the new pairs of pre-defined Full and Day Sessions for US Equity Indexes

Sessions 31 to 33 are dedicated to fit everyone's preferred settings regarding US equity indexes

- Session #31 (which is Investor/RT traditional default futures session) is now named "CME Index FULL Session (DAY=Cash)" as it is associated with the Cash Session #00 (as Day Session)

- Session #32 is now named "CME Index FULL Session (DAY=Pit)" as it is associated with the former Pit Session (#02)

- Session #33 is now named "CME Index FULL Session (DAY=Extd)" as it is associated with the Extended Day Session (#03)

By default, Investor/RT comes with Session 31 defined as default full session for US Equity Indexes. If a subscriber wishes to use another cash session for a given markest (ES, NQ, etc), he should select (in the "Future Types Setup" preferences menu) another full session number, ie Session #32 (for using the former Pit session as Day session) or Session #33 (for using the "Extended" Day Session allowing for a clean split in 2 sessions of the Full Globex session). It can be also done in the instrument setup

Note: for the record, Session #30 is a FULL Globex Session (with no day session attached) while Session #29 is the legacy Globex Session (4.30 pm to 4.15 pm).

Review of the new pairs of predefined Full and Day Sessions for Metals, Energy and Treasuries/FX)

For US commodities or Treasuries, the day session corresponds to the former pit sessions:

- COMEX full session (Session #34) is associated with the former Gold pit session hours (Session #04:8.20 am to 1.30 pm)

- NYMEX full session (Session #35) is associated with the former Crude Oil pit session hours (Session #05: 9.00 am to 2.30 pm)

- CBOT treasuries and CME currencies futures (Session #36) are associated with the former CBOT pit session (Session #06: 8.20 am to 3.00 pm)

- CBOT main agricultural products full session doesn't follow the Full Globex hours, but only trade from 8.00 pm to 2.20 pm (Session #37). It is associated with the corresponding former pit session (Session #07: 9.30 am to 2.15 pm).

Even if all “physical” pits are now closed and transactions are exclusively electronic, using the corresponding pit hours as day session still makes sense, especially when the daily settlement price is still estimated at the end of the former pit session hours. This is typically the case for Gold, Oil, Currencies or US Treasuries, but no longer the case for ES or NQ, whose Settlement prices are now set up at 4.00 pm ET (and not 4.15 pm ET as until 2020)

Note: there are also some specific FULL (short) sessions defined for CME livestocks (Session #38), Forest (Session #39) and Diary products futures (Session #40)

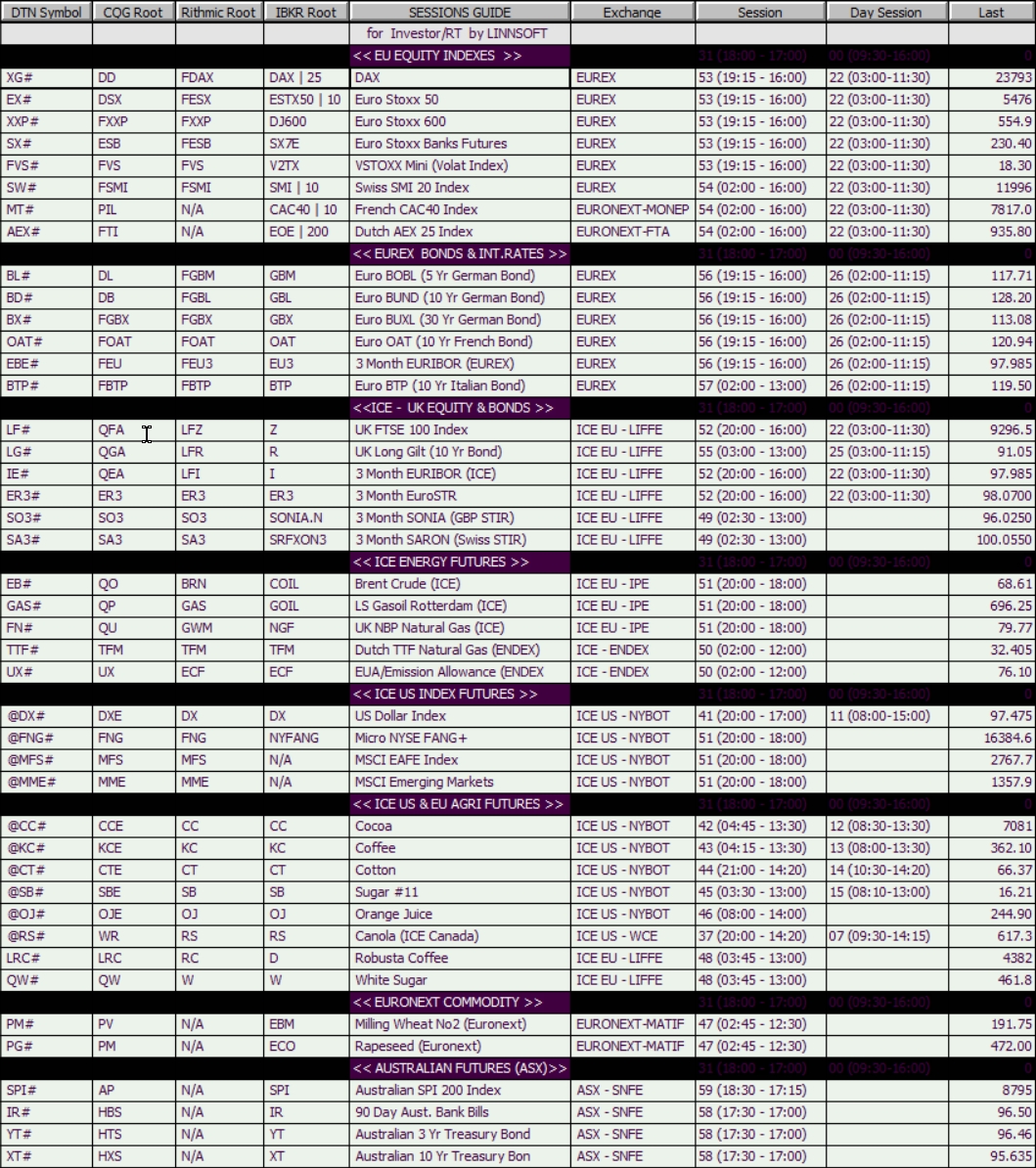

Part 4 - Default settings for all futures trading on EUREX, Euronext, all ICE exchanges (ICE US, EU and Endex) and Asian exchanges

About the current Full Session hours for EUREX futures

Regarding its main electronic session, until December 2018, most of the EUREX key futures markets were trading from 8.00 am to 10.00 pm Frankfurt time (ie 2 am to 4 pm Eastern Time, Session #54), these hours being also matched by the futures trading on Euronext (French and Dutch equity index). At that time, to boost his attractiveness (and arbitrage opportunities), EUREX decided to add an asian overnight session, with an open that would be synchronized with the Singapore market opening time. However, since there is no Daylight Saving Time in Singapore (in contrast to Europe), this means that the Eurex Market reopens (after the 10 pm daily break, local time) at 01:15 am (local time) during winter time, and 1 hour later in summer time. To cover the whole year, the opening time for the full Eurex session is therefore set at 01.15 am (Frankfurt time). Therefore, the current Full Session for most Eurex futures start at 7.15 pm ET and ends at 4 pm ET (Session #53).

About the EUREX key Equity Indexes (DAX, Eurostoxx 50 & 600)

- Contrary to the US situation, there is only one logical choice for all European/UK equity indexes, which is the underlying stock market cash session hours (Session #22: 3.00 am to 11.30 pm), which is the same for the majority of the European (Germany, France, Netherlands, but also UK).

- Please note that, while Eurex manages the Pan-European Euro Stoxx 50 & 600 Indexes, it is only directly responsible for the German DAX 30 futures and Swiss SMI 20 futures (which, for the record, still don't trade during the Asian overnight session). The other actively traded Equity Index markets in Europe are managed by Euronext (France CAC 40 & Netherlands AEX 25) and by ICE (UK FTSE 100)

About the EUREX Bonds

- All EUREX bonds have a settlement time at 17.15, so that the corresponding Bonds "Day Session" can be typically defined from 02.00 am (the former opening time of the electronic Eurex session) to 11.15 am.

- Only, the Italian 2 and 10 year Bonds still trade during full session restricted hours (while the 2/5/10/30 year German and 10 year French bonds trade during the Asian "overnight session")

About the current UK Market Session hours (today ICE Europe, formerly LIFFE)

- The generic FULL session (used by the FTSE index, 3-month Euribor & EuroSTR futures) is 8.00 am to 4.00 pm ET (Session #52). However, SONIA and SARON (the GBP & CHF STIRS) still trade from 2.30 am to 1.00 pm ET (Session #49)

- The associated UK FTSE day session (session #22) is the same one as the main continental stock markets (Germany, France, Netherlands, etc.)

- The Gilt (UK 10-year bonds) only trades from 3 am to 1 pm ET (Session #55). It shares the same settlement time (11:15 am ET) as the current EUREX Bonds and, consequently, has its own Day session (#25) spanning from 3:00 am to 11:15 am. For the record, until the late 80s, the German Bund was mainly quoted in London, on LIFFE, but all Bund trading progressively moved to DTB (the Deutsche Borse, the predecessor of EUREX) thanks to the introduction of its electronic platform in 1990.

About the ICE Europe Energy Futures (formerly IPE) and ENDEX futures

- All Energy futures (Brent and WTI crude oil, Rotterdam Gasoil, UK Natural Gas) trade according to the generic full ICE electronic session (8 pm to 6 pm ET / Session #53)

- ICE ENDEX futures (Dutch TTF Natural Gas, EUA Emission Allowance) have reduced session hours (spanning from 02 to 12.00 am / Session #50)

About the ICE US markets

- The main known ICE US market is the Dollar Index future, trading from 8 pm to 5 pm (Session #41) with the Day session typically matching the Former Pit session hours: 8 am to 3 pm (Session 11#)

- US indexes (MSCI Indexes, NYSE FANG+) follow the generic ICE full electronic session (8 pm to 6 pm / Session #50)

- Each main Agricultural futures (Cocoa, Coffee, Sugar, Cotton,..), still have a specific FULL and DAY session hours (Full Session# 41 to #45, associated with Day Session #11 to #15). Canola (ICE Canada) trades as per the CBOT session hours (Session #37)

About the other European Agricultural markets (ICE Europe/Euronext)

- ICE EU "Soft" Commodities (White Sugar, London Cocoa...) trade from 3.45 am to 1 pm ET (Session #48)

- Euronext commodities (Milling Wheat, Corn...) also trade according to their own hours (Session #47: 2.45 am to 12.30 ET)

Note: ICE EU and US futures are rarely traded by "retail" day traders as they don't offer a reduced exchange data fee for non-professionals. However, please note that, for every ICE market, you have access to all the tick data with your DTN MA subscription (or to delayed data whenever you have a live IQ feed subscription)

Australian and Asian Exchanges

- Every main asian exchange is located in a different time zone: ASX (Sydney) is UTC-10, OSE/JPX (Osaka/Tokyo) are UTC-9, HKFE (Honk Kong) and SGX (Singapore) are both UTC-8. None of these locations follows any DST calendar and each has different Full and Day Session hours.

- Therefore, to keep things simple, we have created 2 generic FULL sessions (resp. Session 58 for all Bond markets, and Session 59 for all equity/commodity futures) that encapsulate every individual market session hours and DST configurations, so that it guarantees that a full data download retrieves all existing quotes. It can, of course, be further customised by every subscriber according to the specific markets being monitored.

Part 5 - Sessions used for stocks, Forex and other non-futures markets (DTN IQ feed / IBKR)

For US Stocks Instrument setup, session #28 (4 am to 10 pm ET) corresponds to the full extended Nasdaq trading session and is associated with the US cash session (Session 00)

For Forex instrument setup: the “boundless” Session #27 (from Sunday, 5pm ET to Friday, 5 pm ET) should be used for setting up any Forex instrument

Please refer to the forex instrument setup page for more information.