The Interactive Brokers symbol guide will be both practical for

- The Investor/RT subscriber relying on a Interactive Broker account as a live data source and therefore using IBKR symbols as the primary instruments in their charts and quotepages.

- The owner of an IQ feed live data subscription, who will be executing orders towards his IBKR account. The very specific instrument setup required in this datafeed configuration is discussed on this page.

Reminder: the instrument setup guide summarizes the other key Investor/RT instrument concepts that you need to know, such as the DTN downloading alias, Investor/RT instrument sessions, the importance of the intraday monitoring status, and the historical data retention settings.

Interactive Brokers Future symbols

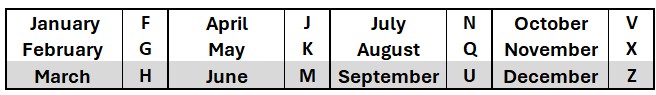

For all exchanges, IBKR Future symbols are made of a Root symbol followed by 'MY’ (contract expiration month and year), with Y the last digit of the contract year and M the month code as per the usual alphabetical letter convention for futures:

So ESU5 is the IBKR ticker for E-Mini S&P 500 quarterly contract expiring in September 2025. Any front-month contract can also be quickly identified on our Rollover Calendar page.

Additional Interactive Brokers requirements for Future symbols definition

What is essential to know is that, for identifying a Futures contract, Interactive Brokers doesn't rely on the sole instrument symbol, but also requires that 5 pieces of information are perfectly matching the internal IBKR symbol definition settings (as visible in the TWS symbol search tools)

- The "underlying" code of the future contract (referred as the IBKR "Root Symbol" within Investor/RT terminology)

- The exchange name (this input should perfectly match the IBKR exchange name)

- The currency of the future contract

- The actual expiration month of the future contract. (Be careful here: this is the actual month of the expiration date of the contract, not the future contract month as indicated by its usual Letter).

- The "multiplier" attached to the IBKR contract definition (if any). indeed, in some cases (highlighted in our symbol guide), IBKR uses the same root symbol for both a full and micro (or mini) contract and relies on a multiplier to identify one of these contracts. The principal consequence of this approach is that any third-party trading application (connecting to IBKR through its API) is only able to connect simultaneously to a single contract among those identified by a multiplier. The main concerned contracts are Eurostoxx 50 (Full and Mini contracts), DAX (Full, Mini and Micro contracts), COMEX Silver futures (Full and Micro contracts) and, since recently, the CME E-Mini Nikkei contracts (Full and Micro contracts)

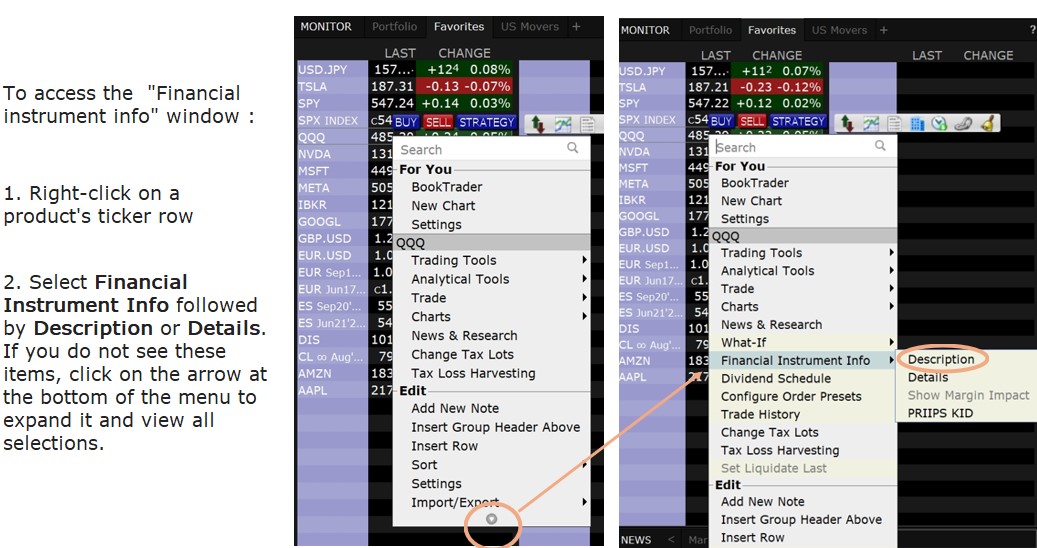

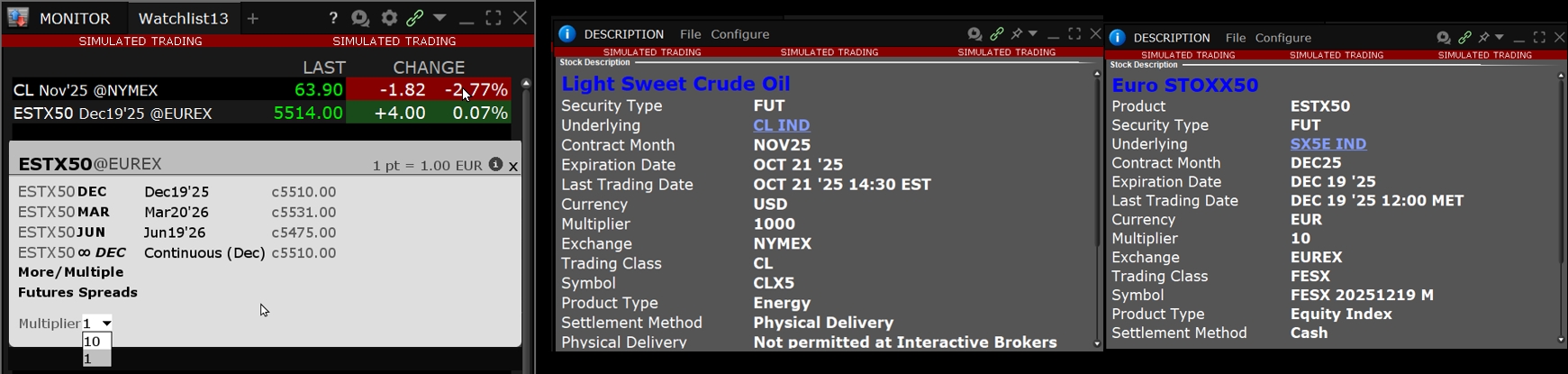

For the record, all this information is accessible in Trader Work Station: Right click on the symbol in on watchlist and choose Financial Instrument Info > Description. Follow the instructions below, as it might be a bit tricky to find this page

About the resulting futures instrument settings windows

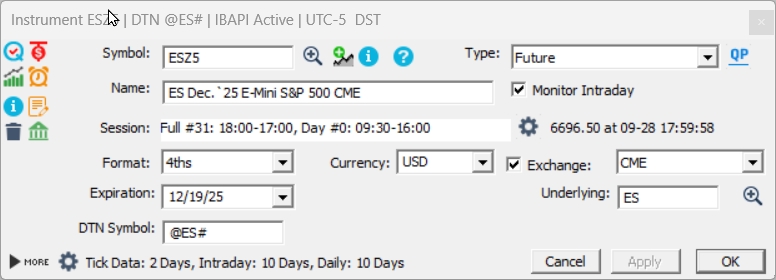

First case: Investor/RT is configured with Interactive Brokers as the datafeed source

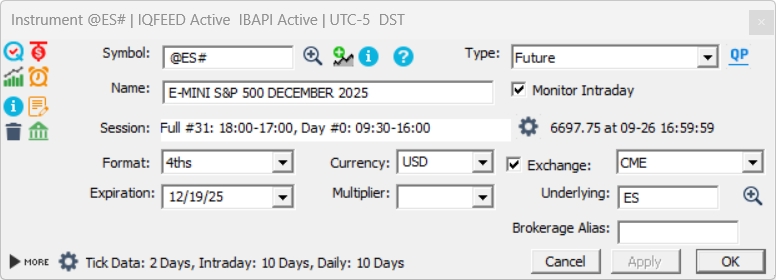

Assuming the contract is already predefined in the Investor/RT future type symbol library (see the 5 symbol tables below), just type the symbol contract name in a Quotepage and data will start streaming. For the vast majority of contracts (such as the S&P E-mini ESZ5 below), I/RT will retrieve the other piece of information from its database and no adjustment is needed.

In only 2 configurations, some manual adjustments are required within the instrument setup window.

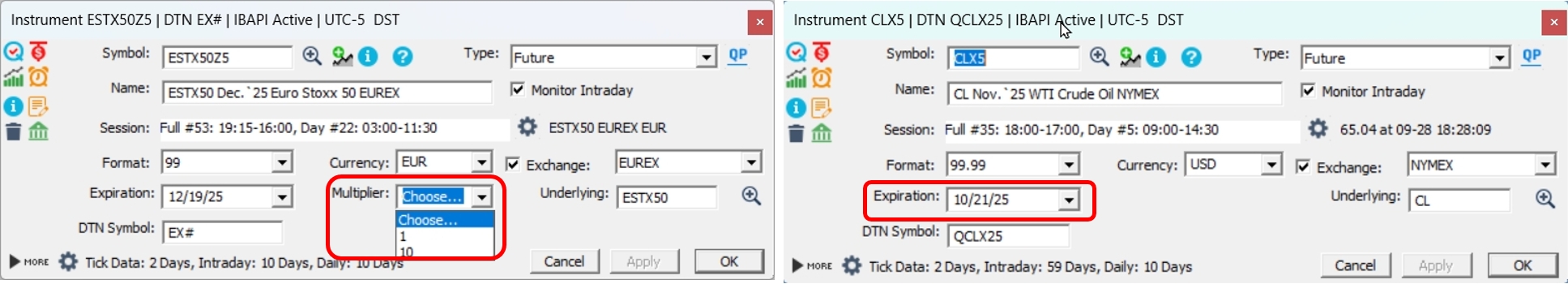

1) When a multiplier input is needed, select the corresponding value in the "Multiplier" checkbox (which will only appear in the instrument setup window for the specific IB contracts requiring such an input). See the example below for the Eurostoxx 50 contract, which has 2 multipliers (1 for the micro contract, 10 for the full-sized contract)

2) When the expiration date is taking place on a calendar month different from the contract symbol month. For example, NYMEX Crude Oil or Natural Gas futures expire in the calendar month prior to the contract month (the November 2025 contract for WTI is set to expire on October 21, 2025). In that case, you need to adjust the mm/dd/yy expiration date to the correct value (as the default value might not be correct)

A final tip: on TWS, there is an easy way to spot contracts with an expiration month different from the contract month. These are the only ones for which the expiration date is not explicitly displayed next to the root symbol. In the above screenshot, the Eurostoxx 50 contract is referred as "ESTX50 Dec19'25 @EUREX" while the Crude Oil future is named "CL Nov'25 @NYMEX". To quickly retrieve a contract expiration date (from a TWS watch list), simply right-click on the symbol name and access the description information available under the "Financial instrument Info" submenu (you can also verify the selected multiplier on this page), or just check our online rollover calendar page.

Second case: I/RT is configured with IQ feed as the main data source, and with IBKR as the brokerage destination.

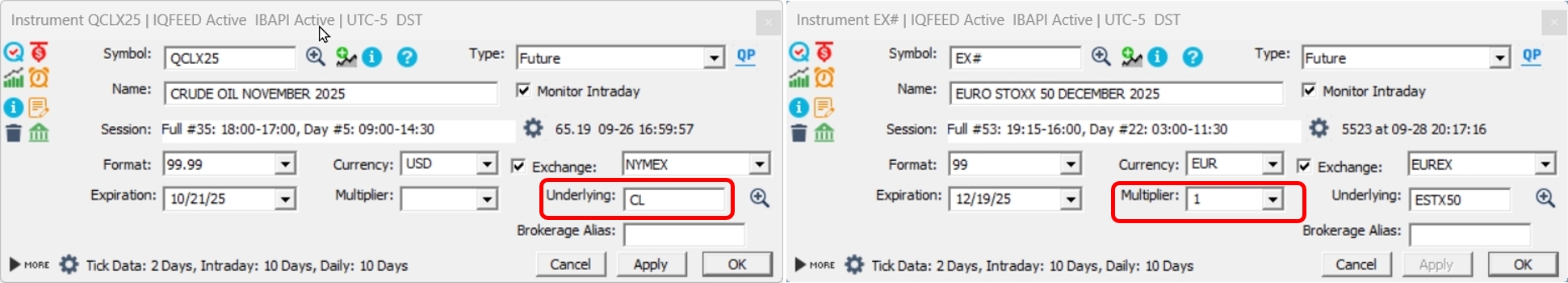

In this specific case, you will need to open the IQfeed Symbol instrument setup window and make sure the “Broker Symbol” box empty (contrary to what can be done when using Rithmic or CQG for order execution), and that the 5 pieces of information ("Underlying" code, expiration date, currency, exchange name and multiplier) are matching IBKR requirements (as detailed in the corresponding columns of our symbol guide tables). Here are the 3 same contracts set up under an "IQ Feed & IBKR" data configuration

In many cases, such as for ES, no manual adjustment is needed as all the parameters (derived from the @ES# instrument setup window) are also correct for IBKR requirements: the underlying (ES) is the same, no multiplier is needed, and the exchange name (CME), expiration date and currency are also correct.

In the case of QCLX25 (the IQ feed symbol for the Nov. 25 NYMEX Crude Oil contract), the native IQ feed underlying code (QCL) needs to be replaced by CL in order to match IBKR requirements. For the Eurostoxx contract, the underlying code (EX) needs to be replaced by the IBKR one (ESTX50) and a multiplier (“1” or "10" ) needs to be included in the Multiplier checkbox (this box systematically appears for any symbol under an "IQ feed + IB API" configuration, but needs only to be filled for the few contracts requiring it)

Interactive Brokers symbol tables

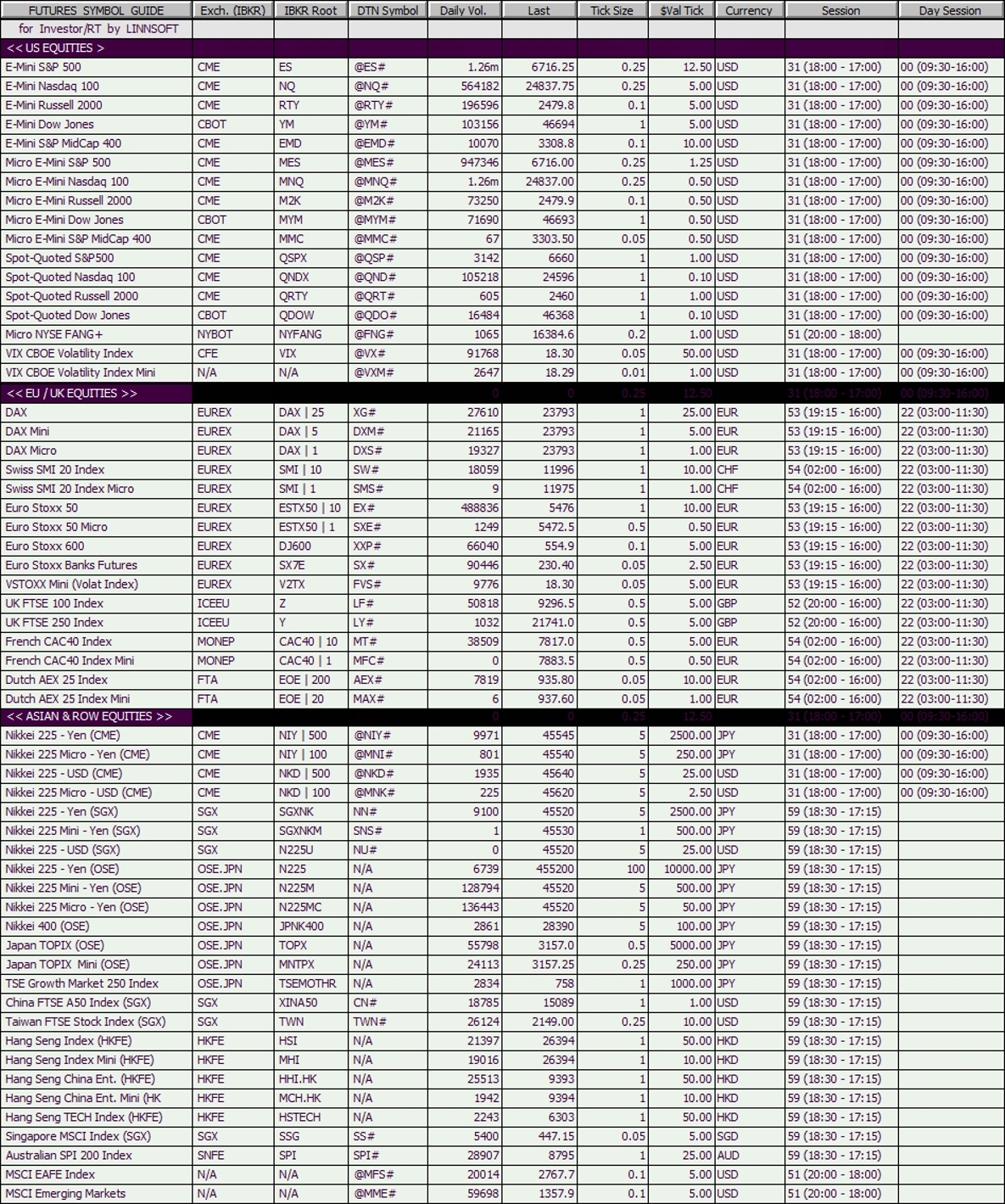

For an easy read, the following 5 tables, gathering futures symbols per market category, highlight the following information

- The IBKR root symbol, possibly followed by the correct multiplier value (when needed)

- The Exchange Name, as per the IBKR requirements

- The DTN symbol for the corresponding continuous future contract, used as "Downloading Alias" (when I/RT is set up with IBKR as the main data source and a DTN MA subscription is active)

- Investor/RT default Full and Day sessions (All in Eastern Time), which are further discussed in the Sessions 101 support page

- A typical daily contract volume (as per the end of Sept 2025) was also included so that you could easily spot futures with very low (or even zero !) volume (that have no value to be monitored)

- The instrument tick size (ie, the minimum bid-ask spread), tick value and contract currency

Table 1A - Equity Index Futures (US, Europe, Asia)

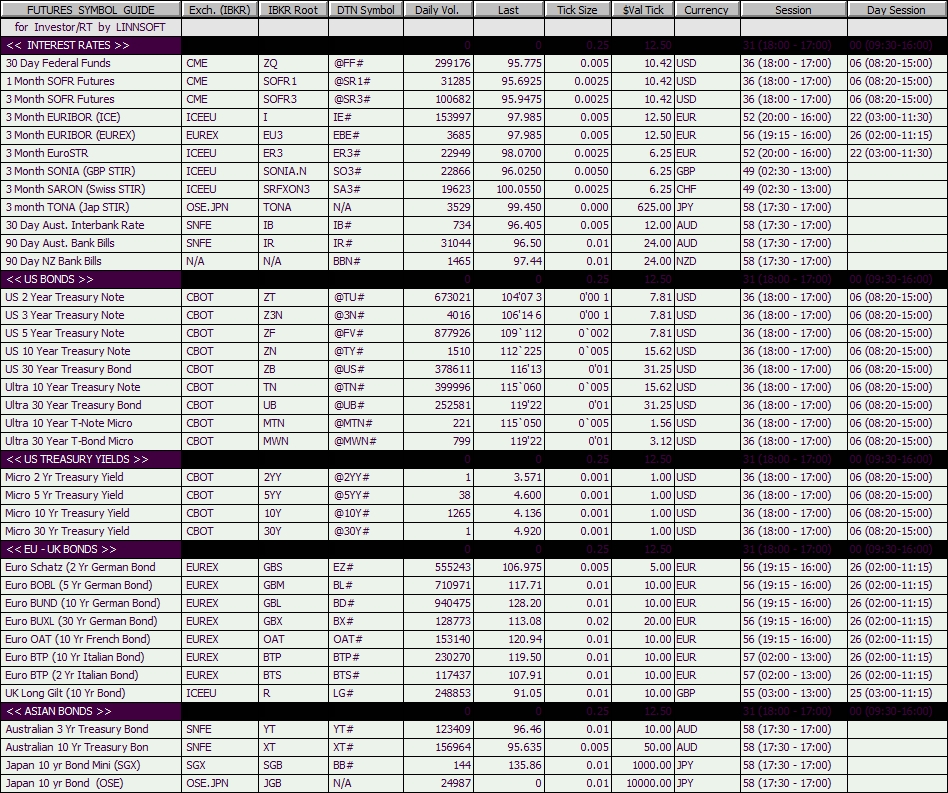

Table 1B - Interest Rates and Bonds Futures

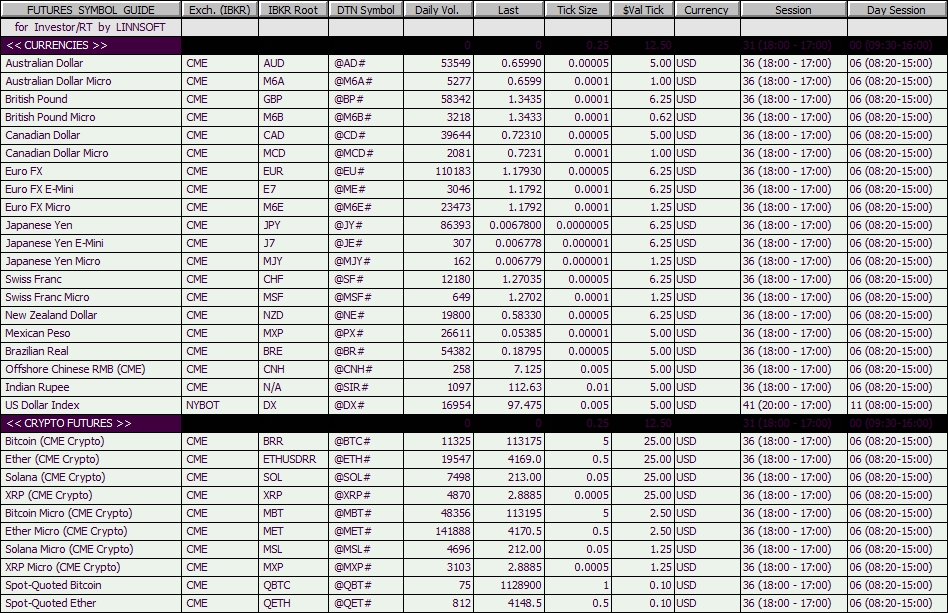

Table 1C - Currencies and Crypto Futures

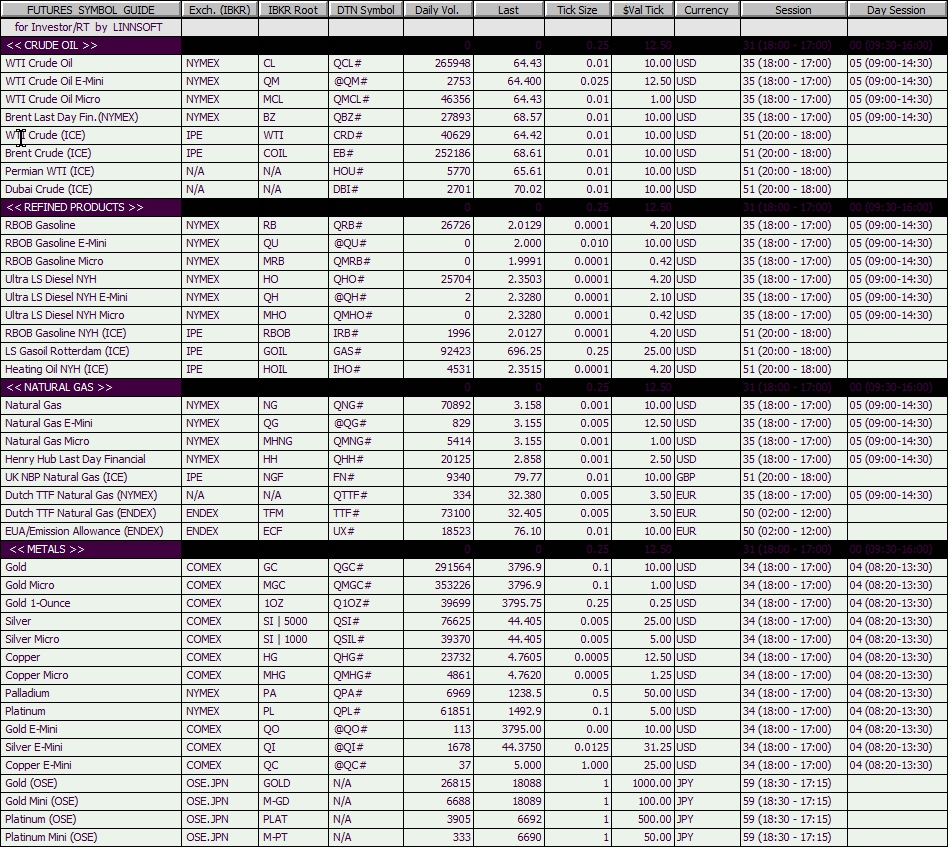

Table 1D - Energy and Metals Futures

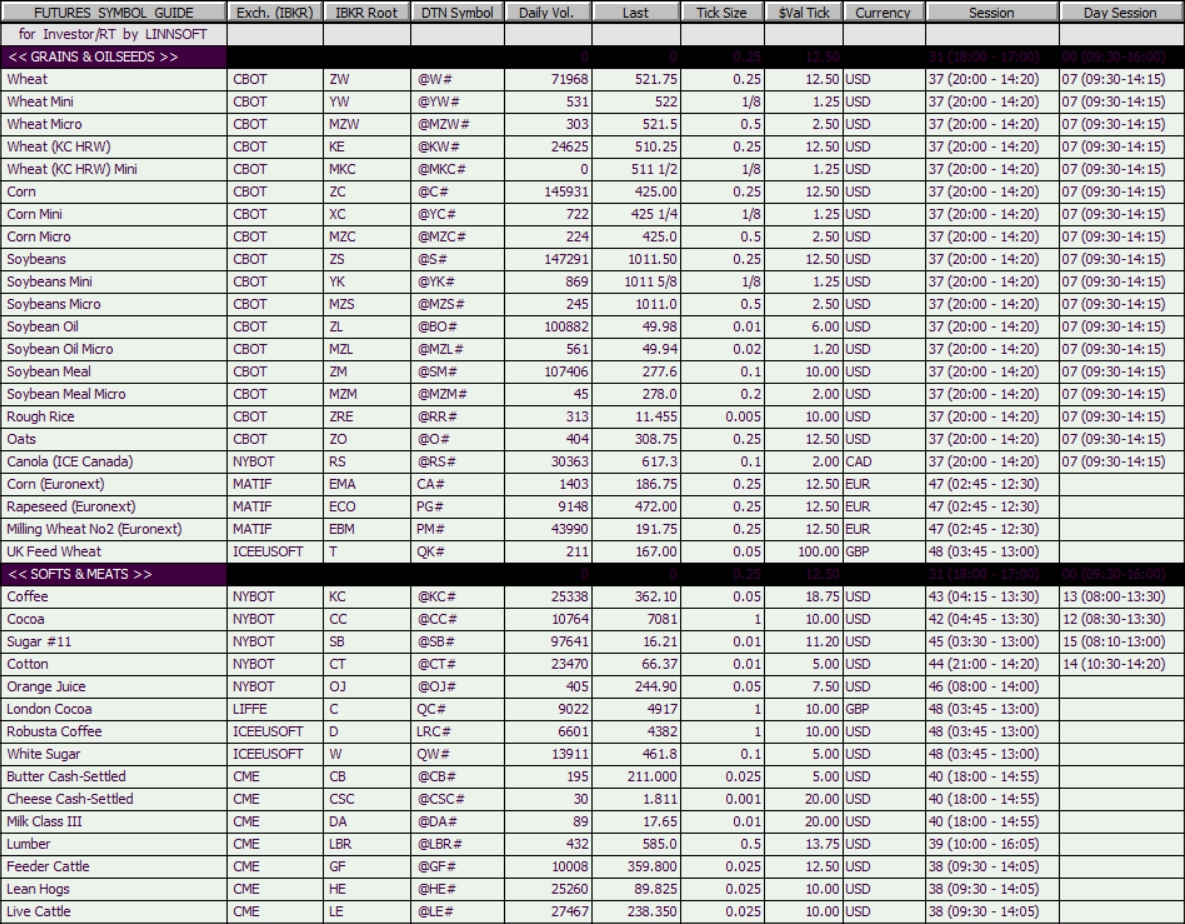

Table 1E - Agricultural Futures

Warning / Good practice: Whenever adding a new symbol for the first time to your Investor/RT instance (or during a rollover procedure), always make sure that the full and day sessions are correct before proceeding with a "full download" operation.

Miscellaneous remarks:

- Always make sure you have subscribed to the right exchange data feed on your TWS account. IBKR can be tricky: seeing live quotes for a specific market on a TWS watchlist doesn't always mean that the corresponding data are available through their API (without paying an additional exchange fee).

- 100 simultaneous market data subscription is typically available for a given (paper or live) account. If a TWS Watchlist is displaying 50 symbols, and the I/RT API connection is retrieving 25 market data lines, this means that an additional of 25 additional market data lines are still available. "Quote Booster package" can be purchased from IBKR (to increase this 100 max. limit)

- If a future symbol is not listed in the above guide, it can always be added to the I/RT default database through the Future Type Setup preference menu. In that case, always verify through the TWS symbol search tool the corresponding futures (especially the underlying code and the exchange name)

- Contact us if you face any issues adding a predefined IBKR to your Investor/RT instance or if you would like to have Linn Software update its future contracts library with a new symbol.

Interactive Brokers Indices & Statistics symbols

| Name | IB Symbol |

IB *Exch |

DTN IQFeed / DTNMA |

| Dow Jones Industrial Avg | INDU | NYSE | INDU.X |

| Nasdaq Composite Index | COMP | NASDAQ | COMPX.X |

| S&P 500 Stock Index | SPX | CBOE | SPX.XO |

| NYSE Cumulative Tick | TICK-NYSE | NYSE | TICK.Z |

| NYSE TRIN | TRIN-NYSE | NYSE | TRIN.Z |

| NYSE Down Volume | VOL-NYSE | VIND.Z | |

| NYSE Up Volume | VOL-NYSE | VINA.Z | |

| NYSE Up - Down Volume | JVNT.Z | ||

| NYSE Total Volume | VINT.Z | ||

| Market Volatility (CBOE) | VIX | CBOE | VIX.XO |

| NYSE Advancing Issues | N/AVideo | IINA.Z | |

| NYSE Declining Issues | N/AVideo | IIND.Z | |

| NYSE Adv minus Decl (Net Issues) | AD-NYSEVideo | JINT.Z | |

| Nasdaq Advancing Iss. | IIQA.Z | ||

| Nasdaq Declining Iss. | IIQD.Z | ||

| Nasdaq Adv minus Decl (Net Issues) | JIQT.Z | ||

| NasdaqCumulative Tick | |||

| Nasdaq TRIN | |||

| Russell 2000 Stock Index | RUT | CBOE | RUT.X |

| Biotechnology Index | BTK | AMEX | BTK.X |

| CBOE Put/Call Ratio | PCRATIO.Z | ||

| Mini Dow Premium | PRYM.Z | ||

| Russell 2000 TRIN | RIRT.Z | ||

| SP Futures Premium | SP-PREM.Z |

Instrument setup for Interactive Brokers US stocks

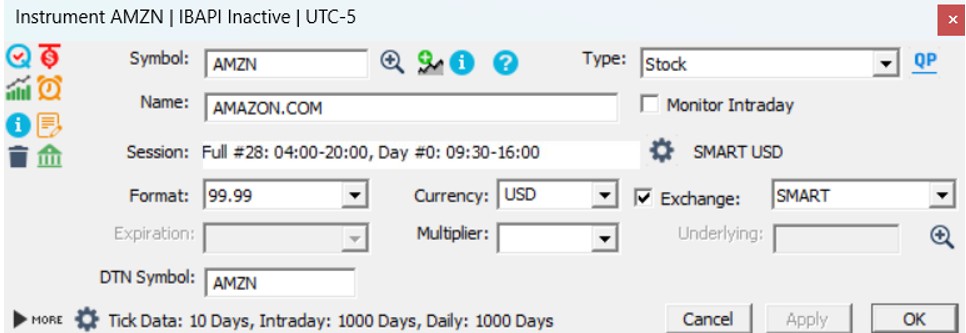

First case: Investor/RT is configured with Interactive Brokers as the datafeed source

For US stocks, "SMART" is generally the recommended "Exchange" setting. Make sure also that the Full and Day Session hours match the ones used for your stock trading hours (by default, the full session might have been initially setup as the cash sessions hours, i.e. session 00, not the Nasdaq extended session) and that the DTN symbol box (that will be used for the DTN MA historical backfill) is also filled up

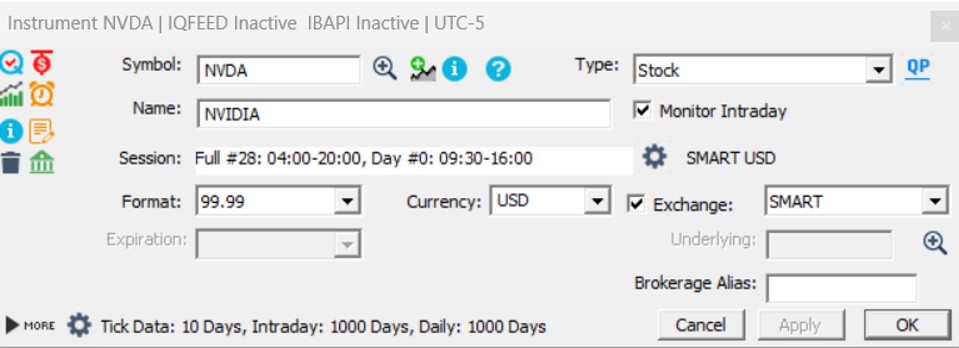

Second case: Investor/RT is configured with IQ feed as the main data source and Interactive Brokers as brokerage destination

In this specific case, you will need to make sure that SMART is also used as exchange. As long as the DTN symbol matches the IB Symbol (this is systematically the case for US stocks), DO NOT FILL up the Brokerage Alias box and leave it empty (as I/RT will use by default the IB Symbol, which is correct according to the DTN symbology)

For symbol additions or corrections, please open a support ticket.