The Rithmic symbol guide will be both practical for

- The Investor/RT subscriber relying on a Rithmic account (from a prop or brokerage firm) as a live data source and therefore using Rithmic symbols as the primary instruments in their charts and quotepages

- The owner of an IQ feed live data subscription, who will be executing orders towards his Rithmic account. In this case, the Rithmic individual contract symbol is added as “Broker Symbol” inside the corresponding DTN instrument settings window

The instrument setup guide summarizes the key Investor/RT instrument concepts that you need to know, such as the DTN downloading alias, I/RT instrument sessions, the importance of the intraday monitoring status, and the historical data retention settings.

Rithmic US Future symbols

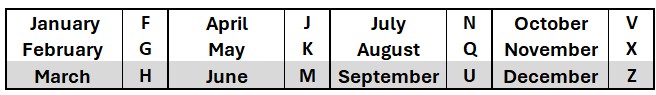

For the CME / CBOT / NYMEX / COMEX exchanges, Rithmic Future symbols are made of a Root symbol followed by 'MY’ (contract expiration month and year), with Y the last digit of the contract year and M the month code as per the usual alphabetical letter convention for futures:

So ESU5 is the Rithmic ticker for E-Mini S&P 500 quarterly contract expiring in September 2025. Any front-month contract can also be quickly identified on our Rollover Calendar page.

Rithmic European Future symbols

For EUREX markets, the contract expiration month is identified with a 4-digit extension "MMYY" (contract expiration month and year), ie the symbol of the DAX contract (root symbol "FDAX") expiring in September 2025 is FDAX0925 (and not FDAXU5)

Rithmic Future symbols for all ICE exchanges

For all ICE exchanges (EU, US, Endex), the future contract symbol is made of a Root Symbol and of a (pretty complex) extension having the format "FMM00YY!", with both components separated by 2 blank characters. Here is the breakdown of the second part: "FM", "00" and the final exclamation point are fixed characters (included in every ICE symbol), the second M is the usual future month contract letter, and the final YY is a 2-digit expiration year. Practically speaking, for the NYBOT Cocoa (Root symbol CC), the March 2026 contract symbol is CC FMH0026!

Rithmic symbol tables

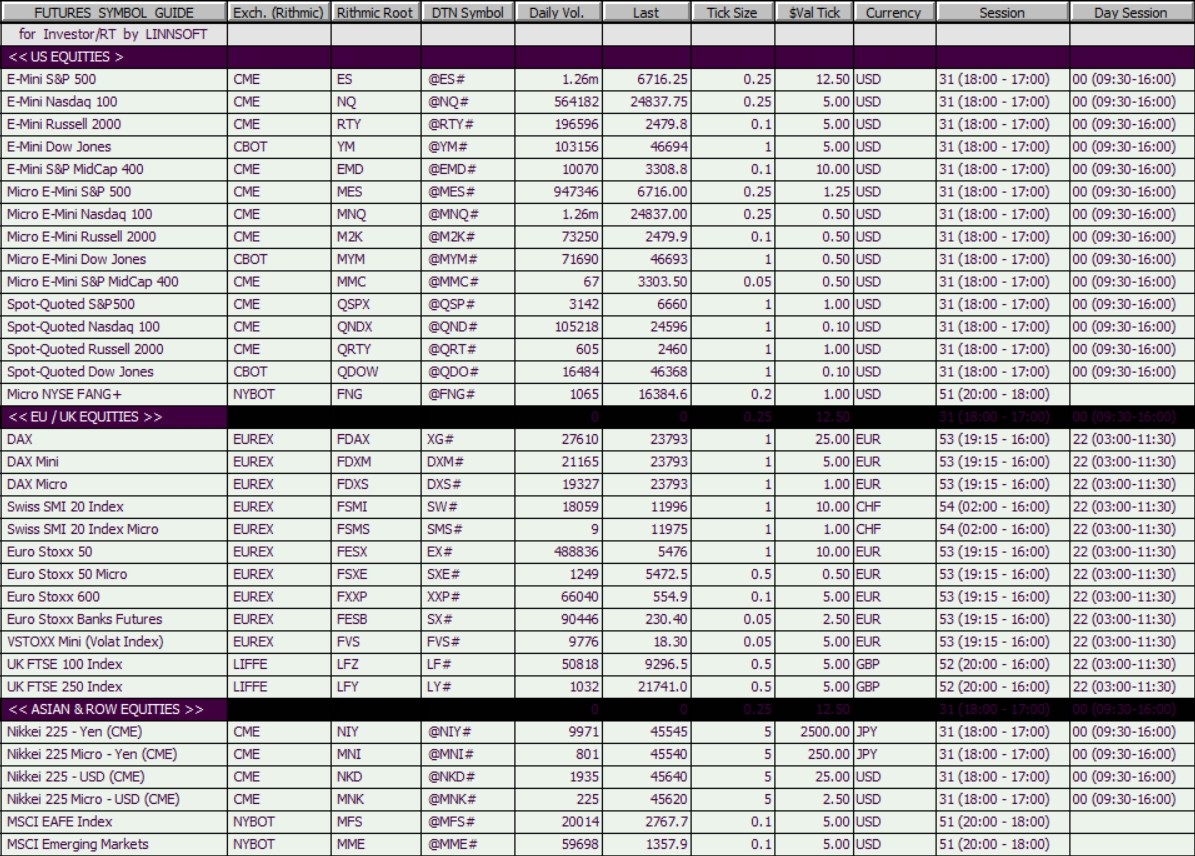

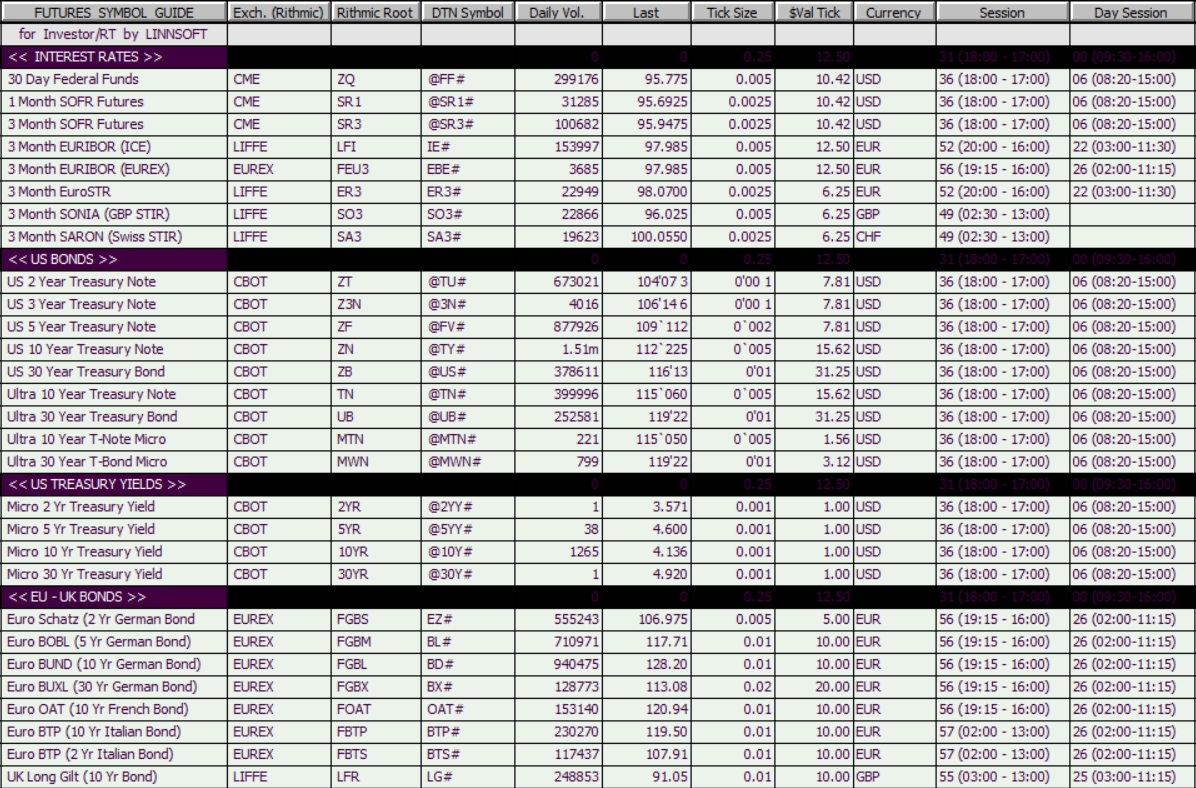

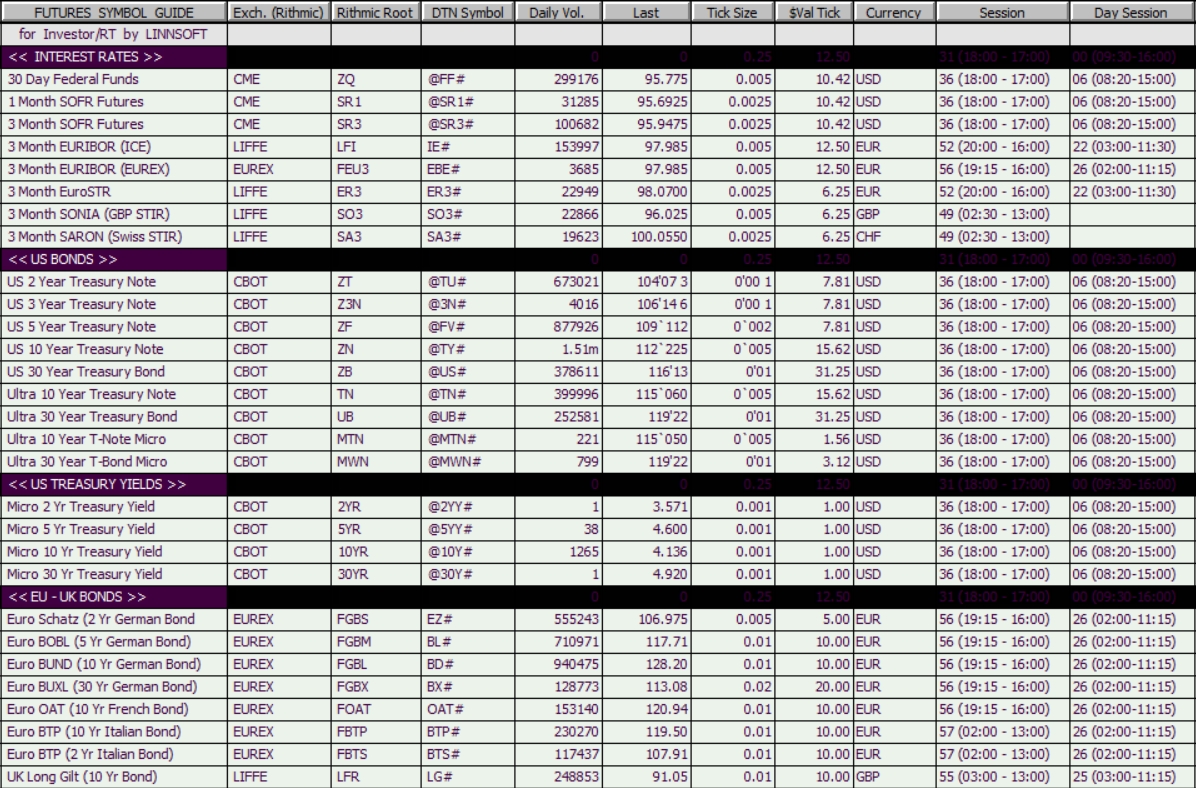

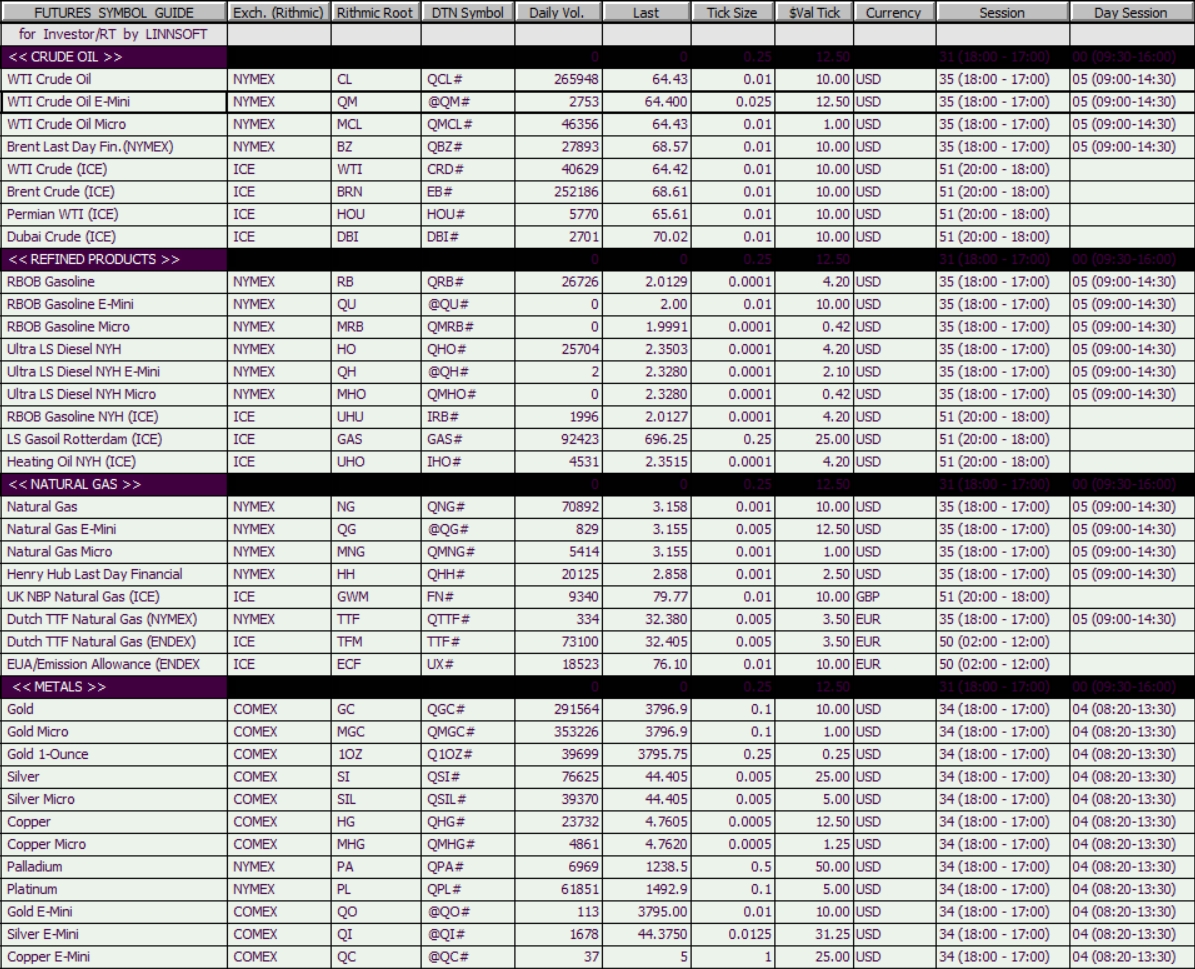

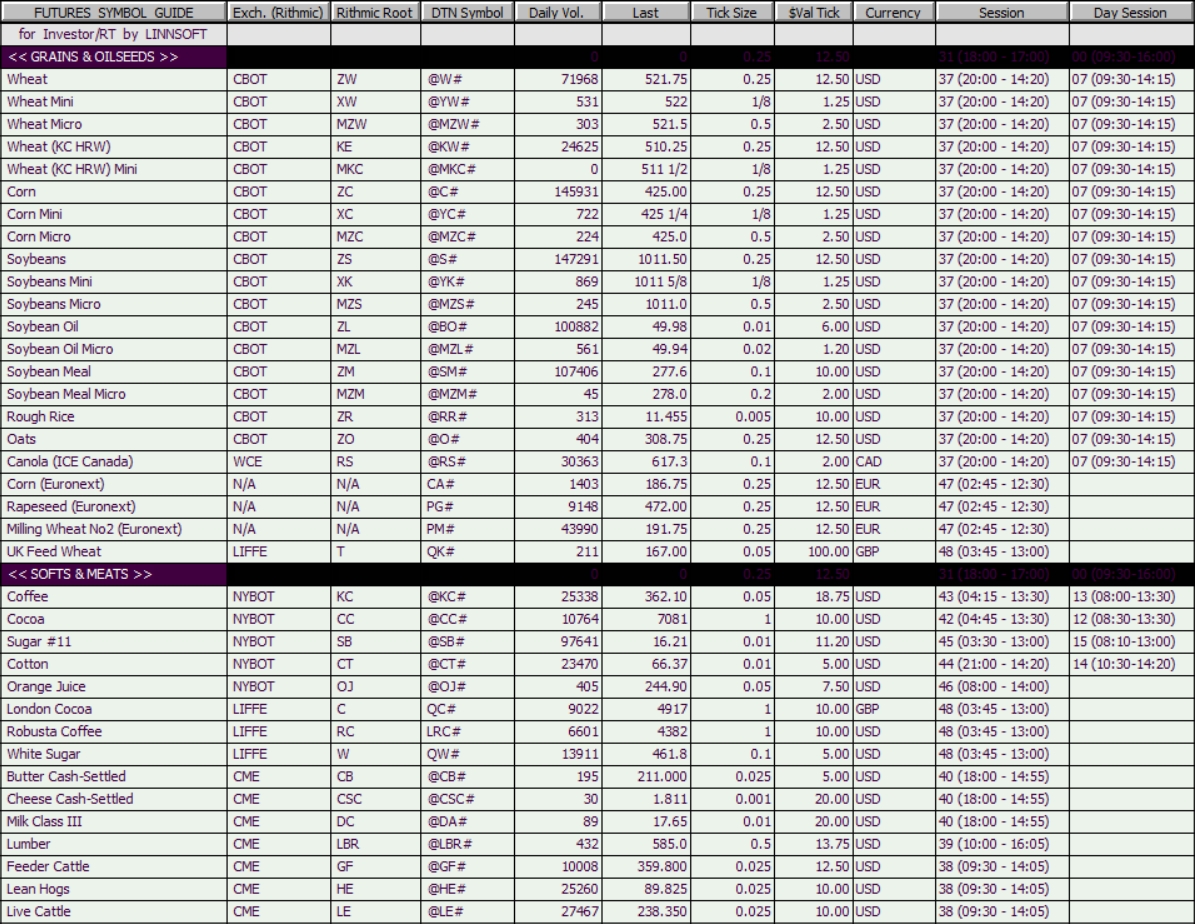

For an easy read, the following 5 tables, gathering futures symbols per market category, highlight the following information:

- The Rithmic root symbol (a valid contract symbol is obtained by adding the adequate extension, as detailed above for each market)

- The DTN symbol for the corresponding continuous future contract, used as "Downloading Alias" in the Rithmic instrument setup window

- Investor/RT default Full and Day sessions (All in Eastern Time), which are further discussed in the Sessions 101 support page

- A typical daily contract volume (as per the end of Sept 2025) was also included so that you could easily spot futures with very low (or even zero !) volume (that have no value to be monitored)

- The instrument tick size (ie, the minimum bid-ask spread), tick value and currency

Warning: In order for any symbol to be correctly identified, the name of the exchange indicated in the instrument setup window must match exactly the name attributed by Rithmic in its symbol library (this is also the case for IBKR, but not for DTN or CQG).

Table 1A - Equity Index Futures (US, Europe, Asia)

Table 1B - Interest Rates and Bonds Futures

Table 1C - Currencies and Crypto Futures

Table 1D - Energy and Metals Futures

Table 1E - Agricultural Futures

Warning / Good practice: Whenever adding a new symbol for the first time to your Investor/RT instance (or during a rollover procedure), always make sure that the full and day sessions are correct before proceeding with a "full download" operation.

Miscellaneous remarks:

- Always check with your broker (or prop firm) the list of futures markets (and data) that are being made available for your account. Paying the market exchange fees for CME or Eurex futures doesn’t necessarily mean that your data provider granted you access to every individual market traded on the CME or Eurex.

- In the rare case your prop firm or brokerage firm would offer a future market not listed above, any Rithmic future symbols not present in the I/RT default database can always be added through the Future Type Setup preference menu.

- Please also note that an integrated symbol search tool is available in the native Rithmic R Trader Pro application.