The DTN symbol guide will be both practical for

- The owner of an IQ feed live data subscription, who will be using these symbols as their primary instrument on their Investor/RT charts

- User relying on a Rithmic, CQG or IBKR brokerage account as a live future data source and on the DTN MA backfill services for their historical data downloads. In this case, the DTN continuous future contract symbol is typically used as “Downloading Alias” inside the corresponding instrument setup

The instrument setup guide summarizes the key Investor/RT instrument concepts that you need to know, such as the DTN downloading alias, I/RT instrument sessions, the importance of the intraday monitoring status, and the historical data retention settings.

Part 1 - DTN Future symbols

IQ feed Future symbols are made of 2 parts:

- For continuous contracts: the DTN root symbol followed by #

- For individual contracts (with an expiration date): the DTN root symbol followed by 'MYY’ (contract expiration month and year), with YY the last 2 digits of the contract year and M, the month code as per the usual alphabetical letter convention for futures:

So @ES# is the ticker for E-Mini S&P 500, and @ESU25 is the ticker for the quarterly ES contract expiring in September 2025. Any front-month contract can also be quickly identified on our Rollover Calendar page.

Warning: not all DTN contracts start their root code with a @ QCL# (Crude Oil) or QGC# (Gold) are among the exceptions.

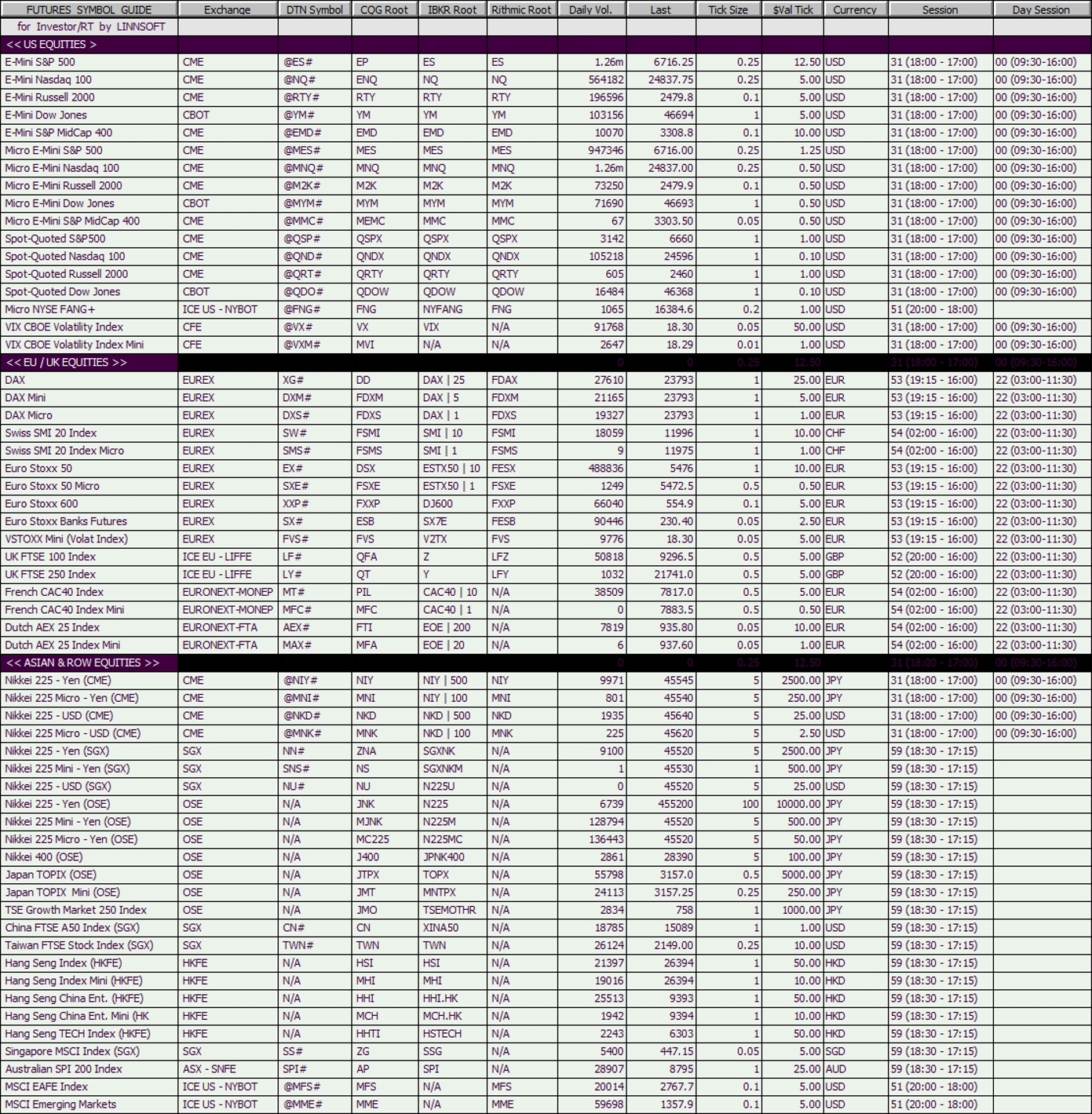

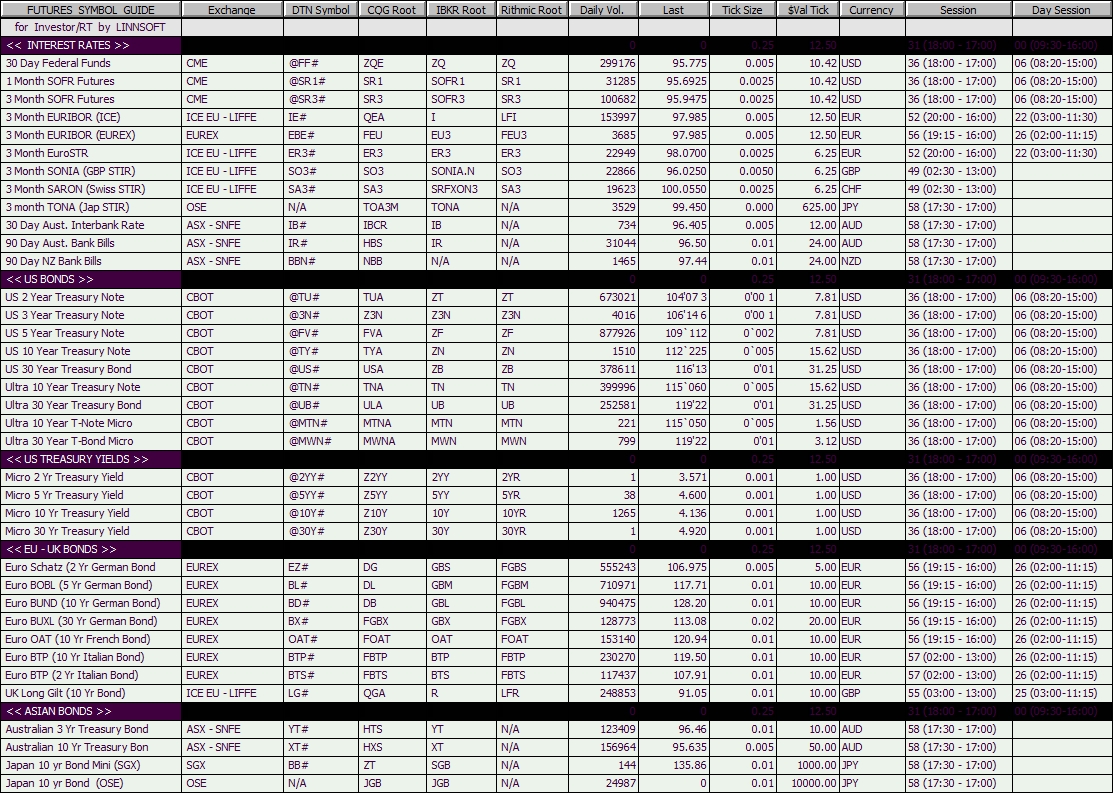

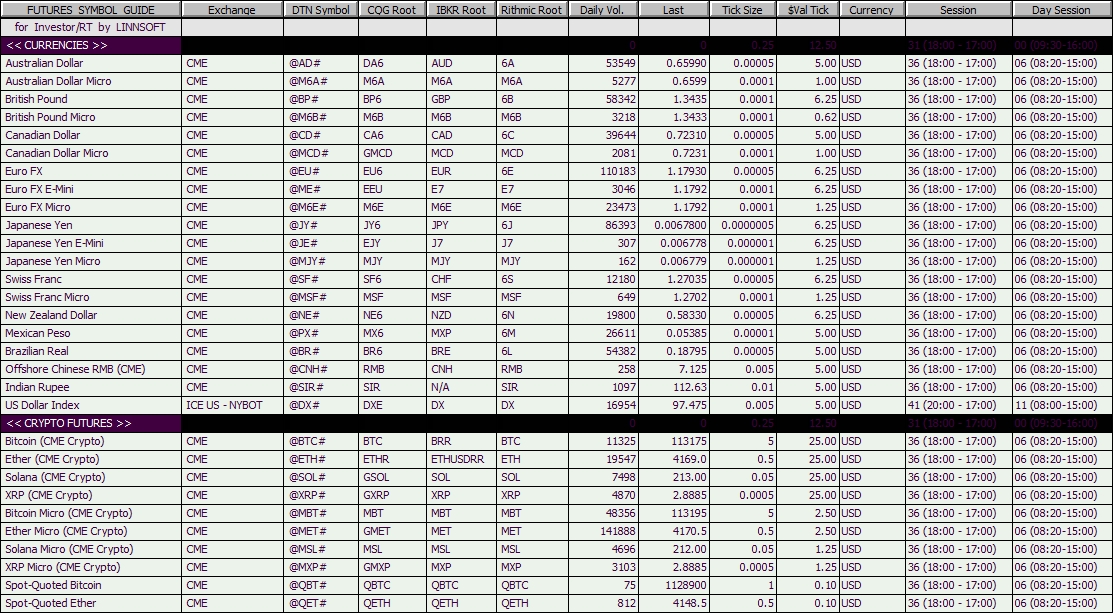

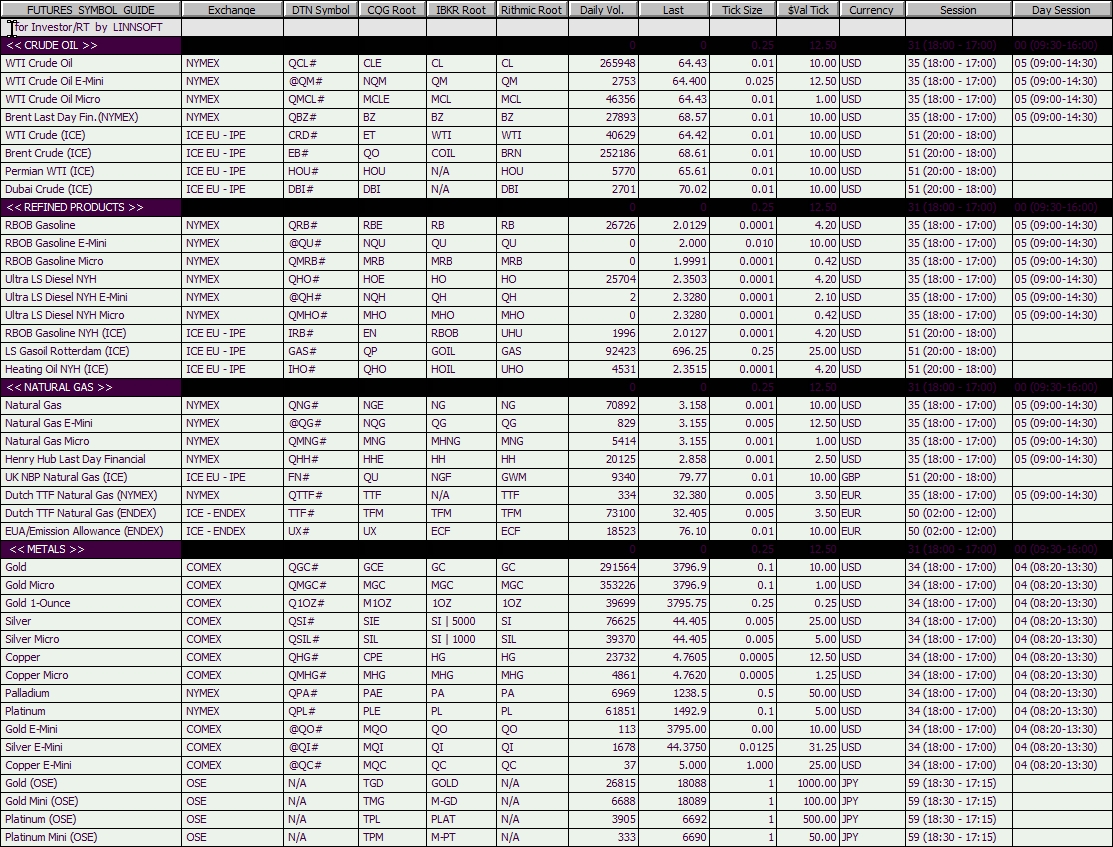

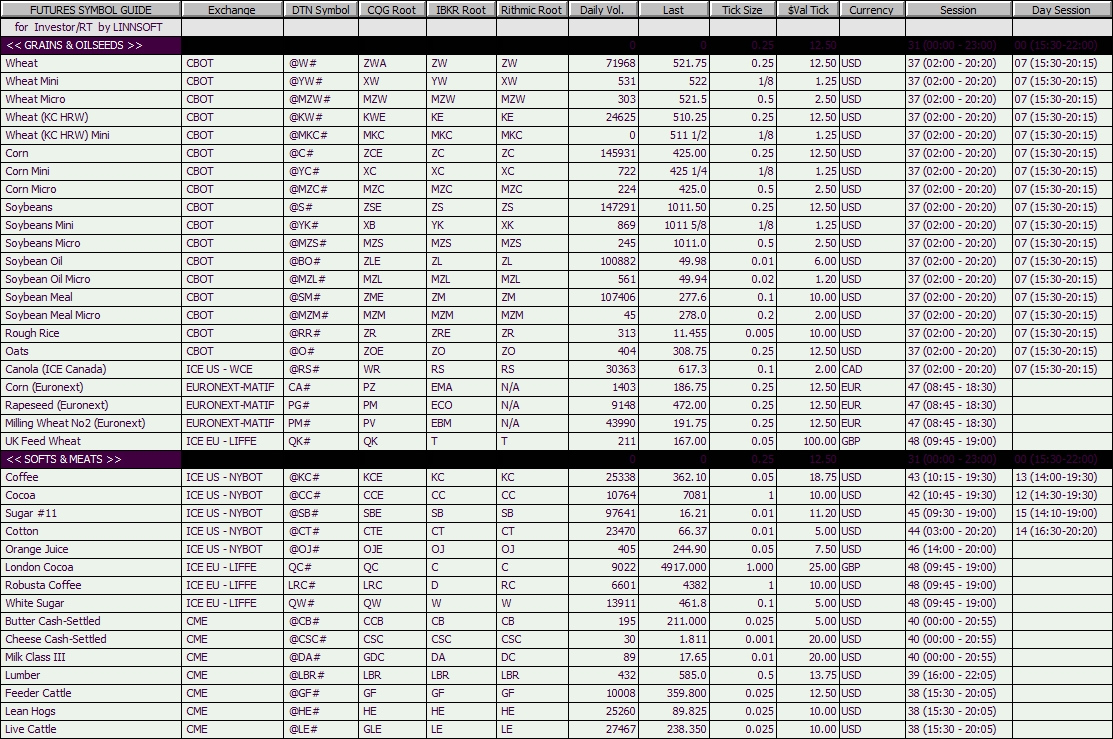

For an easy read, the following 5 tables, gathering future symbols per market category, highlight the following information:

- The DTN symbol for the continuous future contract

- The corresponding root symbols for Rithmic, CQG and IBKR (that will be useful for IQ feed subscribers when adding the "Broker Symbol" within their instrument setup). Please refer to the respective Rithmic, CQG, or IBKR symbol guide for more information on the precise date extension (typically MYY or MY) to be used to obtain a complete broker symbol.

- Investor/RT default Full and Day sessions (All in Eastern Time), which are further discussed in the Sessions 101 support page

- A typical daily contract volume (as per the end of Sept 2025) was also included so that you could easily spot futures with very low (or even zero !) volume (that have no value to be monitored)

- The instrument tick size (ie, the minimum bid-ask spread), tick value and currency

Remark: The 5 tables below also include an "Exchange" column for information purposes only. This input is not essential in the case of DTN (and could be left to "AUTO" when manually setting up a new future). Indeed, as this is also the case with a live CQG subscription, based on the symbol ticker, I/RT will automatically retrieve from the DTN servers the exchange name information (At the opposite, a Rithmic or IBKR ticker will only be recognized if the exchange name of the Investor/RT instrument setup window is perfectly matching the one stored in their own symbol library)

Table 1A - Equity Index Futures (US, Europe, Asia)

Table 1B - Interest Rates and Bonds Futures

Table 1C - Currencies and Crypto Futures

Table 1D - Energy and Metals Futures

Table 1E - Agricultural Futures

Here are some final comments about DTN future symbols:

- The newest CME/CBOT Spot-Quoted contracts introduced in July 2025 have only one expiration date (June 2026). It is therefore best to use the M26 contract directly (for example, @QSPM26).

- The DTN coverage of future markets goes beyond the symbols listed on these 5 tables. It also includes futures traded on the following exchanges: LME, MDEX (Malaysia), BMF (Brazilian Merc. & Futures Exchange) and SAFEX/JSE (Johannesburg).

- However, DTN is not covering 2 Asian markets (HKFE and OSE), as highlighted by the N/A in the symbol column. In that case, if using, for example, CQG data as the primary live source with DTN MA for backfill, it is essential, in the corresponding CQG instrument setup window, to include "N/A" as the "downloading alias". This way, Investor/RT will automatically use by default the CQG historical data server for any backfill requests (while continuing to use DTN MA for the other CQG symbols having a DTN downloading alias)

- Any DTN futures listed on their website search tool, and not present in the I/RT default database, can be added through the Future Type Setup preference menu.

- Contact us if you face any issues with this process or if you would like to have Linn Software update its catalogue of predefined future contracts with a particular symbol. The list of future type setup is refreshed automatically each time Investor/RT starts up or by running File > Functions > Refresh Futures Definitions.

Warning / Good Practice: Whenever adding a new symbol to your Investor/RT instance for the first time (or during a rollover procedure), ensure that the full and day sessions are correct before proceeding with a "full download" operation. This should be the case for Future symbols, but not necessarily for any cash indexes or statistics listed in the coming tables(if their full session doesn't correspond to the default US cash session #00)

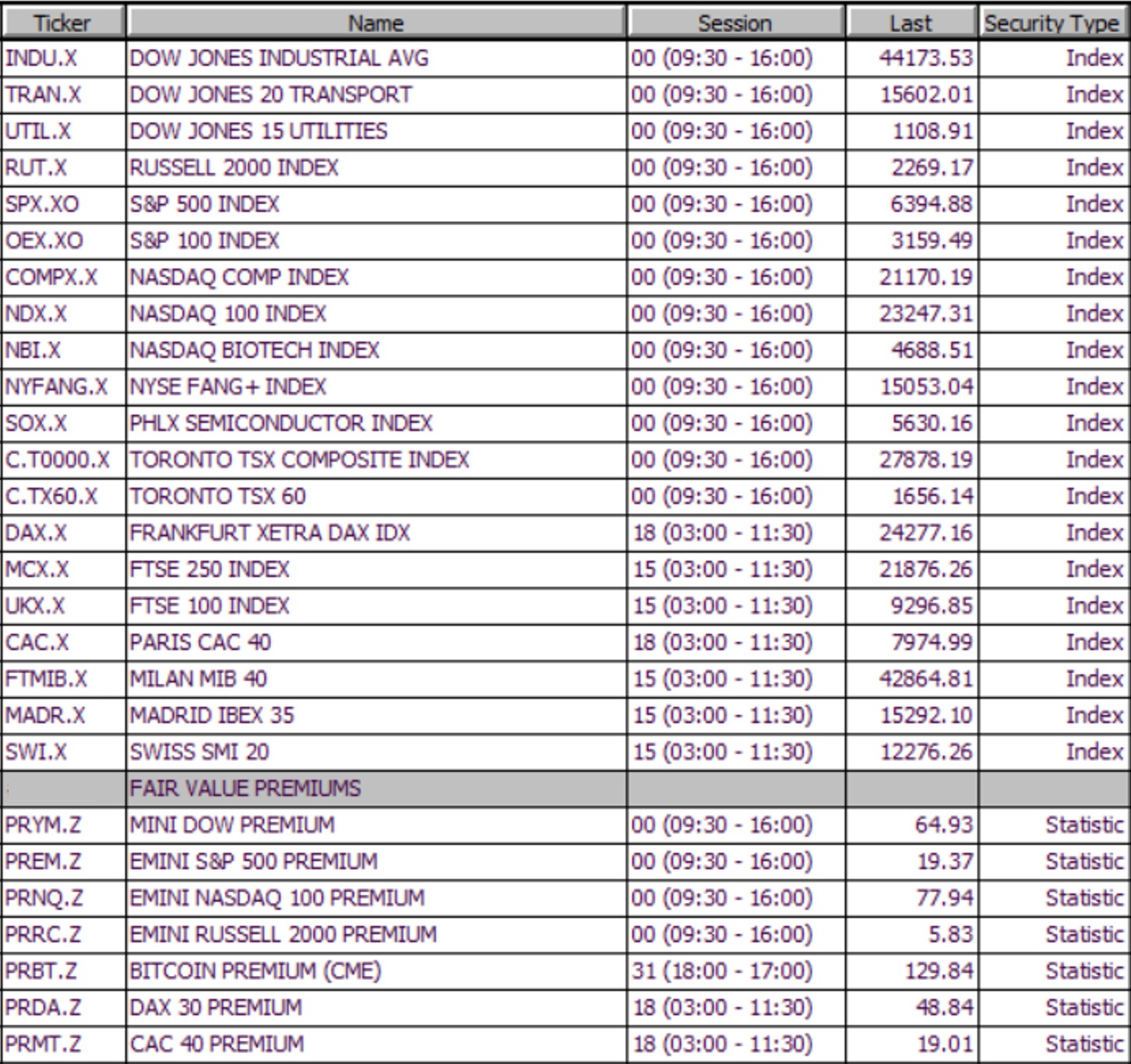

Part 2 - DTN Cash Indexes (and Fair Value Premiums) for North American and European markets

The following table gathers the most common North American and European cash market indexes, together with the “Fair Value premium” (as calculated by DTN..)

Part 3 - Financial and CBOE Indexes (DX, VIX indexes, Treasuries yields & more)

DTN provides a long list of CBOE indexes, especially VIX and Note Yields. Here is a short compilation, together with some other financial indexes (Dollar index, Fedfund & SOFR)

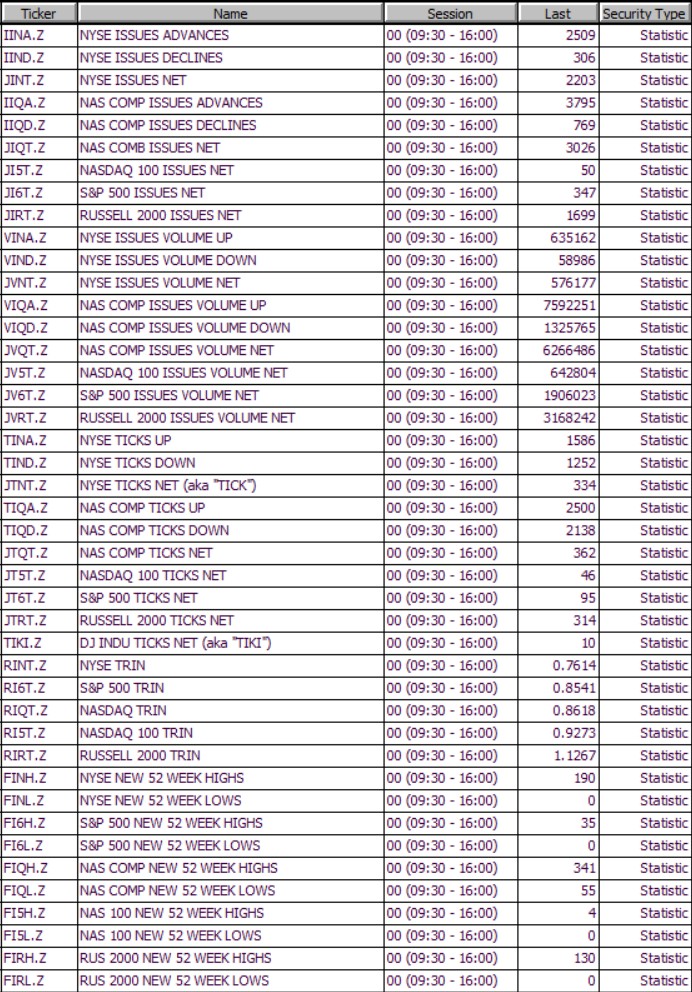

Part 4 - DTN Market "Internals" statistics

Market internals are a set of metrics that provide insights into the underlying dynamics driving the market by analyzing breadth, volume, and sentiment.

NYSE TICK and TRIN are 2 of the most well-known indicators: TICK can be accessed by TICK.Z or JTNT.Z, while TRIN.Z or RINT.Z returns the same NYSE TRIN value (also known as Arms index)

This DTN reference document provides details about all the calculation methods for all their market internals quotes (more than 1000 statistics are available)

The following table gathers 50 of the most commonly used statistics.

Note: For IQ feed subscribers, these market statistics are included in any core package (no additional dedicated subscriptions are required), and the corresponding values are updated every second.

Part 5 - A short sample of DTN Stocks & ETF symbols

Here is a sample list of stocks, along with some common ETFs (SPY, QQQ, etc.), including the one commonly used for the S&P market breakdown into sectors (XLC, XLI, XLK, etc.). The weight of each sector in the S&P index (as per July 2025) has been added for information in this table (in the sector name). Check the latest value here: https://www.sectorspdrs.com/

If a stock trades according to the Nasdaq extended trading hours (4 am to 10 pm ET), then the full session of the corresponding ticker should be adjusted accordingly, with the "Day Session" associated with the Full Nasdaq session being the regular US cash session.