Average Directional Movement Rating quantifies momentum change in the ADX. It is calculated by adding two values of ADX (the current value and a value n periods back), then dividing by two. This additional smoothing makes the ADXR slightly less responsive than ADX. The interpretation is the same as the ADX; the higher the value, the stronger the trend.

The ADXR, being a smoothed version of ADX, and can be used similarly to the ADX in the three rule system discussed on the ADX section..

The ADXR is a measure of the spread between the Directional Indicators (+DI and -DI). When the ADXR is declining, it's not advised to use a trend following system. However, a rising ADXR signals that the dominant trend is likely to continue. A rising ADXR, with both the ADXR and DI+ above the D- indicates a strengthening bullish market. The scan syntax needed to represent this condition would be...

ADXR > DIMINUS AND DIPLUS > DIMINUS AND ADXR > ADXR.1

A rising ADXR, with both the ADXR and DI- above DI+ indicates a strengthening bearish trend. The scan syntax needed to represent this condition would be...

ADXR > DIPLUS AND DIMINUS > DIPLUS AND ADXR > ADXR.1

If the ADXR has been below both DI+ and DI- but has begun to rise a new market trend is emerging. The scan syntax needed to represent this condition would be...

ADXR < DIPLUS AND ADXR < DIMINUS AND ADXR > ADXR.1

See Also: ADX See Also: +DI DI- : Directional Indicator See Also: TR : True Range

Presentation

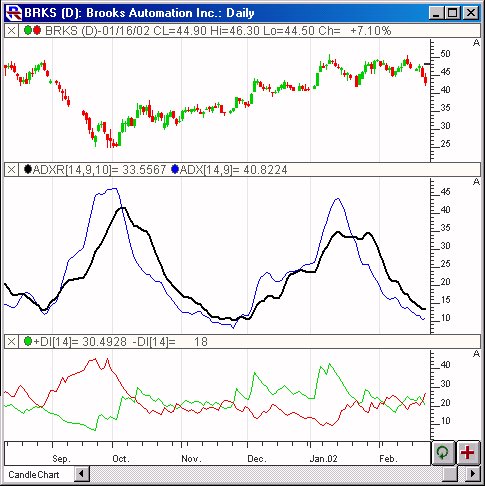

Above is a Daily Chart of Brooks Automation Inc. (BRKS). The middle pane shows the ADXR line in black, along with the ADX line in blue. In the lower pane, the directional indicator has the DI+ line in green and the DI- line in red. The Preferences

Formula

Keyboard Adjustment

Keyboard Adjustment The DX Period, the Smoothing Period, and the ADXR Period all can be adjusted directly from they keyboard without opening up the preference window. First, select the indicator, then use the up and down arrow keys to adjust the DX Period up or down by one. To adjust the Smoothing Period, hold down the ctrl-key while hitting the up and down arrows on your keyboard. To adjust the ADXR Period, hold down the shift-key while hitting the up and down arrows on your keyboard.