COG is an oscillator based on an article by John F. Ehlers on page 20 of the May 2002 issue of Stocks and Commodities Magazine. COG has essentially zero lag and enables clear identification of turning points. This indicator is a result of Ehlers research into adaptive filters. The Investor/RT implementation of COG includes an option to "Volume Weight" the oscillator. When this option is checked, volume will be used in addition to price to weight the indicator.

Presentation

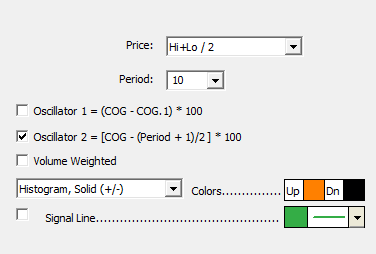

Above is a Daily Candlestick Chart of the Intel Corporation (INTC). The blue line in the lower window pane represents the Center of Gravity Oscillator drawn using the preferences displayed below. The red line is the signal line. The bars are overlaid with scan markers showing the turning points of the Center of Gravity.

Formula

Keyboard Adjustment

The Center Of Gravity period can be adjusted directly from the keyboard without having to open up the preferences window. Just select the indicator and then hit the up or down keys on your keyboard. The up arrow key increases the period by 1 while the down arrow key decreases the period by 1.