The TRIX is a momentum indicator that calculates the percent rate of change of a triple smoothed exponential moving average of closing price. It is a leading indicator, in that it is designed to signal trends shorter than the time sample used to calculate the TRIX. However, you introduce more lag time into the indicator response as the moving average period is increased. The TRIX oscillates around a zero line. Trading opportunities arise when the TRIX graph changes direction. Buy when the slope of the TRIX line turns positive or crosses zero from below. Sell when the slope turns negative or crosses zero from above. Divergence in the movement in price and the TRIX line can also signal an impending trend change.

Presentation

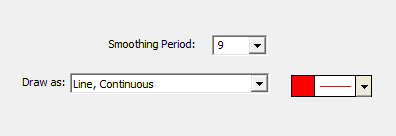

Above is a Daily Candlestick Chart of the Nasdaq Composite Index (COMPX). The bold blue line represents a 9 period TRIX indicator, as specified in the preferences below. The TRIX indicator is overlaying the candlestick chart, with the vertical scale corresponding to the TRIX values.