Welles Wilder described these calculations to determine the trading range for a stock or commodity. True Range is defined as the largest of the following:

- The distance from today's high to today's low.

- The distance from yesterday's close to today's high.

- The distance from yesterday's close to today's low.

Wilder included price comparisons among subsequent bars in order to account for gaps in his range calculation.

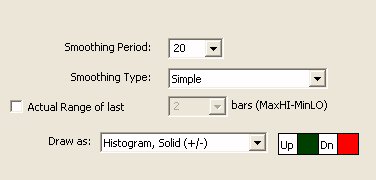

The raw True Range is then smoothed (a 14-period smoothing is common) to give an Average True Range (ATR). The True Range can be smoothed using a variety of moving average types, including Simple, Exponential, Welles Wilder, etc.

ATR measures a security's volatility. It does not indicate price direction or duration, rather the degree of price movement. Average True Range can be interpreted using the same techniques that are used with the other volatility indicators.

Wilder states that high values of ATR often occur at market bottoms following a sell-off. Low ATR values are often found during extended sideways or consolidation periods.

Several other indicators are built off True Range, including DI+/DI-, ADX, and ADXR. RTL Tokens . . . TR ( more )

The True Range indicator is represented in RTL using the token TR. This token also represents the Average True Range if a smoothing period is specified. When comparing the TR value among instruments that don't trade in the same price range, it may be useful to normalize by dividing by price, and possibly multiplying by 100. The following scan syntax is an example...

TR * 100 / CL > 6.0

Keyboard Adjustment The True Range smoothing period can be adjusted directly from they keyboard without opening up the preference window. First, select the indicator, then use the up and down arrow keys to adjust the period up or down by 1.

Presentation

Above is a Daily Chart of Microsoft (MSFT) . The blue line in the lower window pane represents a moving average of the True Range, as specified in the preferences below. The Preferences