The volatility indicator is based on the same calculation used by Investor/RT in the options analysis feature of the program. The volatility is calculated historically for each bar. Volatility can either be computed based on the periodicity of the chart, or annualized. For example, if your chart is a 1 minute chart with a volatility period of 21 with the "Annualize volatility" checkbox unchecked (not annualized), then the volatility displayed in the indicator would represent a 1 minute volatility based on the past 21 bars in your 1 minute chart. On the other hand, if you choose to "Annualize" your volatility, then the number in the volatility indicator will represent a one year volatility for your instrument computed based on the past 21 bars in your one minute chart. The expectation is based on one standard deviation (68% probability). So if the annualized volatility is 30% and the current price is 100, then you should expect 68% of the time that the price will remain between 70 and 130 (100±30%) over then next year. Similarly, if the 1 minute volatility (not annualized) is 0.1% and the current price is 100, then you should expect 68% of the time that the price will remain between 99.9 and 100.1 (100±0.1%) over then next minute bar. Prior to version 3.8, the volatility could be calculated and displayed as a quote page column where the value represents the present volatility. Now the volatility may be viewed graphically to see how it has changed over time for an instrument.

See Also: Black-Scholes Volatility Calculations

Presentation

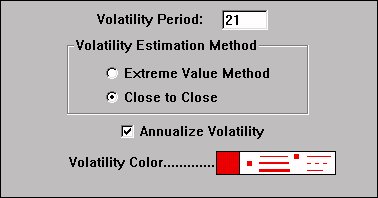

Above is a Daily Candlestick Chart of the Microsoft Corporation (MSFT). The red line in the lower window pane represents the annualized volatility of MSFT, as specified in the preferences below.