IMPORTANT

If you have run Investor/RT without closing it through the weekend when Daylight Saving Time (DST) changes took place in the US, it is recommended that you exit Investor/RT and start up again.

In most of the US, Daylight Saving Time begins on the 2nd Sunday in March, and ends on the 1st Sunday in November. Some time zones do not follow this schedule or do not observe Daylight Saving Time at all. The instructions below address the various software setup revisions that must be made during the transitions to/from Daylight Saving Time by Investor/RT users who reside in locales that are out-of-sync with the US with regard to DST status.

If you are outside of the US in a time zone that does not follow the same schedule as the US, you may be on Standard Time while the US has moved to DST (or visa versa). During this period, typically one to three weeks in duration, you must temporarily adjust (shift) the Investor/RT session setups that you use by one hour. These considerations primarily apply to users of data source IQFeed and users of broker supplied data sources who have DTN Market Access historical services on their subscription. The reason for this is that DTN historical data is transmitted with New York local time stamps and these timestamps are on DST during some periods of time and Standard Time on others. We will review in detail the most common cases about the US and European markets

Reminder of DST calendar impact on US / EU markets opening time

DST is a well known issue for experienced daytrader. Indeed,

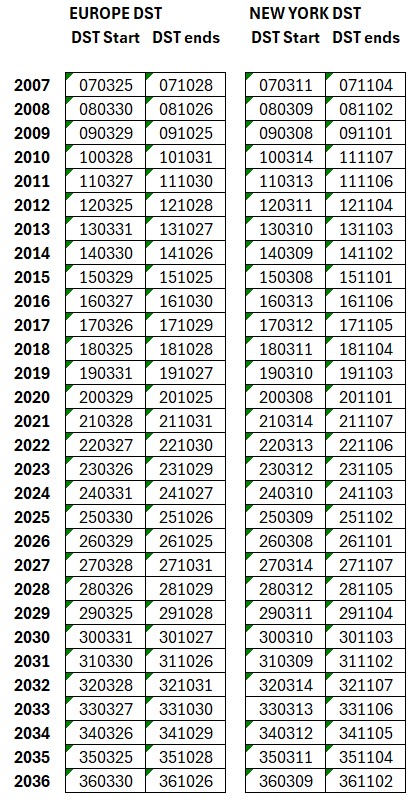

- Since 2007, New York DST starts the second Sunday of March and ends the first Sunday of November

- Since at least 2000, European DST starts the last Sunday of March and ends the last Sunday of October (same date in both Germany / France / UK ..)

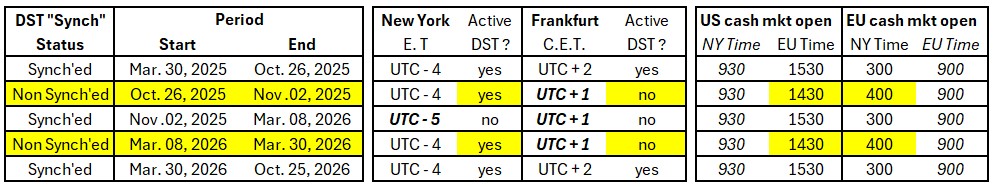

As both DST dates are not the same on both sides of the Atlantic, this does lead, twice a year, to what we internally refer to 2 periods with “Non synchronized DST” weeks, as summarized in the table below.

During this one week period end of October and 2 or 3 weeks period in March, Eastern Times (NY) is only 5 hours ahead of Central European Times (Frankfurt / Paris) instead of 6 hours whenever both DST status are synchronized.

Consequence: for the EU based trader, US cash market will open one hour earlier (14.30 instead of 1530 CET), while for the US trader, the EUREX cash market will open at 4 am (NY time) instead of 3 am.

How does Investor/RT the data time stamp (for both live data reception and historical data download) during DST non synched weeks.. ?

First, it is important to notice that, obviously,

- if you trade the US markets only (and you are based in the US , following the NY DST calendar)

- or if you are based in Europe and only trades EU futures

you have no modification to do in terms of Investor/RT session settings because the market always open at the same (local) time of the day

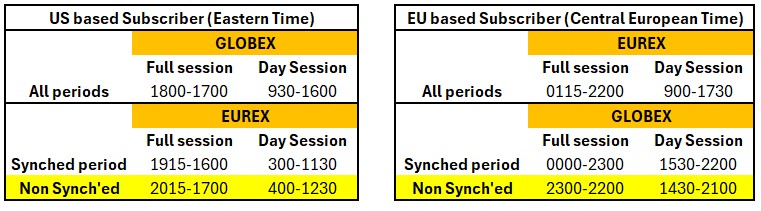

However, if you are based in the US and monitor EU markets, or if you are based in Europe and monitor US futures, you will need

1) before the open of the monday session (marking the start of a "non synched" DST period) to temporarily adjust the session hours of the corresponding products (see table below)

Since Investor/RT 14, the File > Functions feature includes a convenience function for shifting all sessions, or a specific session, by 1 hour. In the File > Functions window, enter the word shift or sessions to find function names Shift Session +1 Hour and Shift Session -1 Hours. When either of these functions is selected, a menu button at bottom right offers choices for which session(s) to adjust. You may adjust all sessions or a specific session and its associated day session. The menu lists the names and times of each session you have that are assigned one or more symbols.

2) Perform a full data download so that All historical data (including quotes during any past “synch'ed” or "non synched" periods) are (temporarily) switched to the new session hours, i.e. this full download will reposition intra-day historical data timestamps in light of your revised session start/end times

Indeed, the global data management principle for historical data download is that Investor/RT will adjust the original DTN time stamp according to the current Session hours (ie DST status)

What does it mean precisely: for a EU trader, all past time stamps for US futures will be modified according to the temporary session hours, i.e. 11 pm to 10 pm (EU times) instead of midnight to 11 pm, so that all past data timestamps are aligned with the updated session definition used for the US futures during the DST “non synch’ed” periods.

The main benefit is that the whole data series of US quotes remains consistent, time stamp wise. If you are using a session statistics indicator to perform initial balance statistics, it will always really compare apples to apples, ie what really happened during the first hour of the cash session. When the DST “non synched” period is ending, you will need to adjust the US instrument session again to the traditional session hours and do a full data download for US futures (typically on Sunday, after the clock were adjusted in New York). All time stamps will be shifted, bringing back the US market timlestamp aligned with the usual 1530 cash market opening time (including for the quotes which had a one hour earlier timestamp during the non-synch weeks). This way, any historical statistics based on time will still be correct for any volume or delta analysis based on the session statistics average at time features (or the homework indicator)

Notes: the same logic applies for a US based trader monitoring EU futures. If you are based in the US, ie you need to adjust session hours for EU futures and perform a full data download for all EU instruments at the start (and end) of each DST non synch'ed period, so that you can keep performing consistent analysis and statistics on EU futures markets.

Certain U.S locales, e.g. Arizona, Indiana, Hawai.. that do not observe DST at all may also use the File > function session shift features. When the rest of the US goes onto DST, users in these locales can shift their sessions -1 hour. Later in the year when the the US goes back on Standard Time, a shift +1 hour can be done. This requires no artificial changes to your locale time zone settings in Windows. Remember to do a Full Download after shifting to readjust the historical data.

Remark: Investor/RT keeps track in its database of both US and EU actual DST periods since 2007 so that any download of data through DTN will have a consistent set of EU and US time stamps, correcting the "non synch-ed" periods.